Cybersecurity Firm SentinelOne Explores Options

SentinelOne Inc (S.N), a cybersecurity company with a market value of about USD 5 billion, has been exploring options that could include a sale, according to people familiar with the matter.

Nvidia Earnings Will Serve As A Gauge On A.I. Market Demand

Nvidia (NVDA.O) investors expect the chip designer to forecast quarterly revenue above estimates when it reports results this Wednesday. The company has been the biggest beneficiary of the rise of ChatGPT and other generative A.I. apps, virtually all of which are powered by its graphics processors.

Oil Dips On Possible Easing Of Tight Supply

Oil edged lower today as the market waited to see if Iraqi oil exports resume, which could ease the supply tightness caused by the OPEC+ cut, while a faltering Chinese economy continued to undercut the global demand outlook.

Today’s News

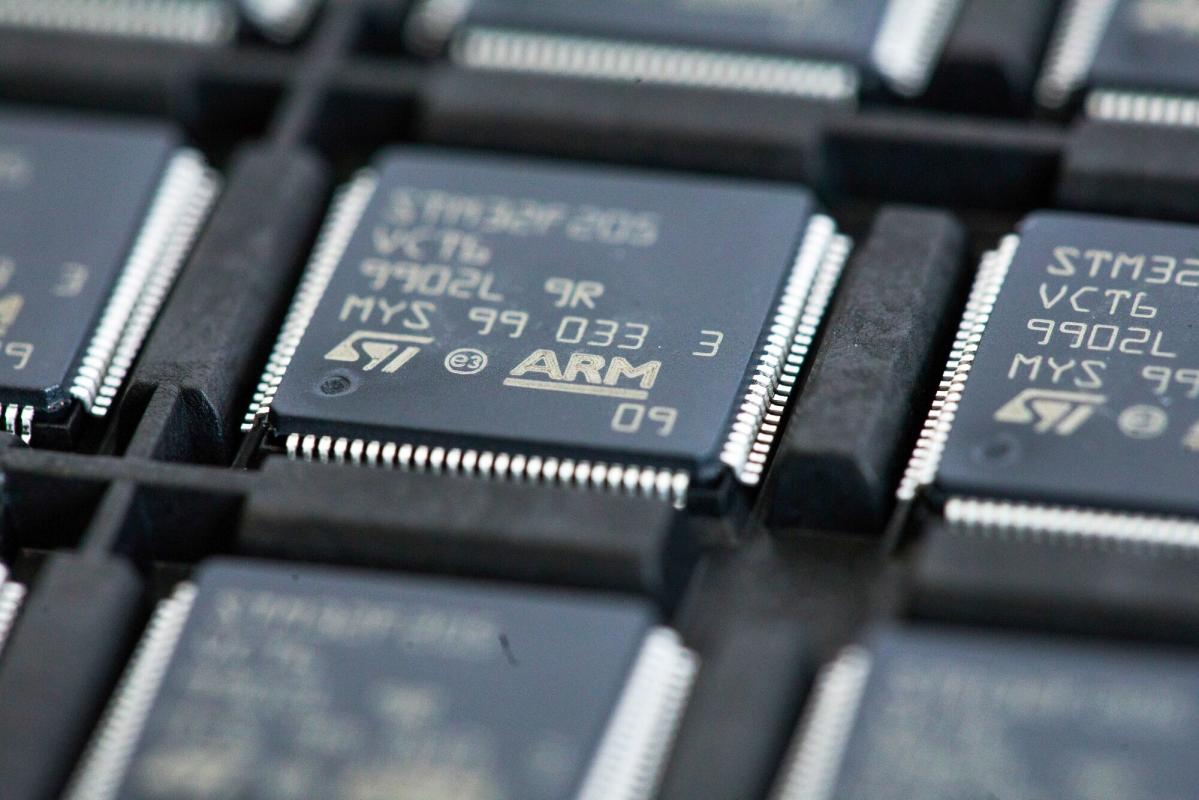

SoftBank Group Corp.’s Arm Holdings Ltd. is gleaming with stardom as it lunges forward to what is set to become the biggest U.S. initial public offering of the year! A bet that the once-obscure designer of phone chips can flourish in the era of artificial intelligence (A.I.) computing.

In a long-awaited regulatory filing yesterday, Arm claims that the offering is being led by Barclays Plc, Goldman Sachs Group Inc., JPMorgan Chase & Co. and Mizuho Financial Group Inc. The document listed 24 other underwriters below that top tier — with Morgan Stanley notably absent.

A successful debut by Arm would completely change the course for SoftBank founder Masayoshi Son, whose Vision Fund lost a record USD 30 billion last year. It could also spur dozens of companies to pursue — or further delay — their own IPO plans. That includes businesses such as online grocery-delivery firm Instacart Inc., marketing and data automation provider Klaviyo and footwear maker Birkenstock.

Arm aims to kickstart its roadshow in the first week of September and price the IPO in the following week, a Bloomberg report indicated. For now, the company did not disclose any proposed terms for the share sale in the document, but it is expected to amass a valuation between USD 60 billion to USD 70 billion. Arm, based in Cambridge, U.K., also held talks with some of its biggest customers about backing the IPO.

Other related news include:

Arm Seeks To Ride The A.I. Wave Of 2023

Arm Ltd. is responsible for designing key parts of the semiconductors that power almost every smartphone on the planet. The IPO is likely to draw in some of its biggest customers as anchor shareholders, and even some competitors, all of which are keen to uphold the neutrality that is vital to Arm’s projected success.

Arm designs core semiconductor components and licenses the blueprints, along with the fundamental code that governs how the software communicates with the chips. The arrangement brought in USD 2.68 billion revenue in the fiscal year that ended on March 31, making Arm one of Britain’s largest technology companies. Japan’s SoftBank Group Corp. acquired Arm for USD 32 billion in 2016, delisting it from the London Stock Exchange. SoftBank founder Masayoshi Son has regularly talked up the potential for Arm’s future growth, saying he wants the debut to be “the biggest” in the history of the chip industry. Raising as much as USD 10 billion would make it the largest in the U.S. since electric vehicle (E.V.) maker Rivian Automotive Inc.’s USD 13.7 billion offering in November 2021. It could rank near or even just below the tech industry’s largest ever IPOs: Alibaba Group Holding Ltd. raised a whopping USD 25 billion offering in 2014 and Meta Platforms Inc. (then called Facebook Inc.) brought in an astonishing USD 16 billion in 2012.

Arm’s Valuation Correlates With A.I. Hype

Hours before Arm Ltd.’s initial public offering filing is expected to land, investors are taking matters into their own hands as they scrutinize a handful of reported financial metrics for clues on whether the lofty valuation the company proclaims to be seeking makes sense.

The chip designer tries to cash in on investors’ frenzy for stocks that can benefit from the rise in A.I. SoftBank Group Corp., which owns Arm, bought a 25% stake in the company from Vision Fund at a collosal USD 64 billion in valuation.

Morgan Stanley Stays Out Of The Picture

In a surprising turn of events, there’s no sightings of Morgan Stanley in Arm Ltd.’s draft filing for its initial public offering, a rare event for a bank that’s often at the forefront of landmark technology IPOs.

Arm’s listing is planned for September, and it is on track to becoming the year’s largest and potentially biggest tech listing of all-time on a U.S. exchange.