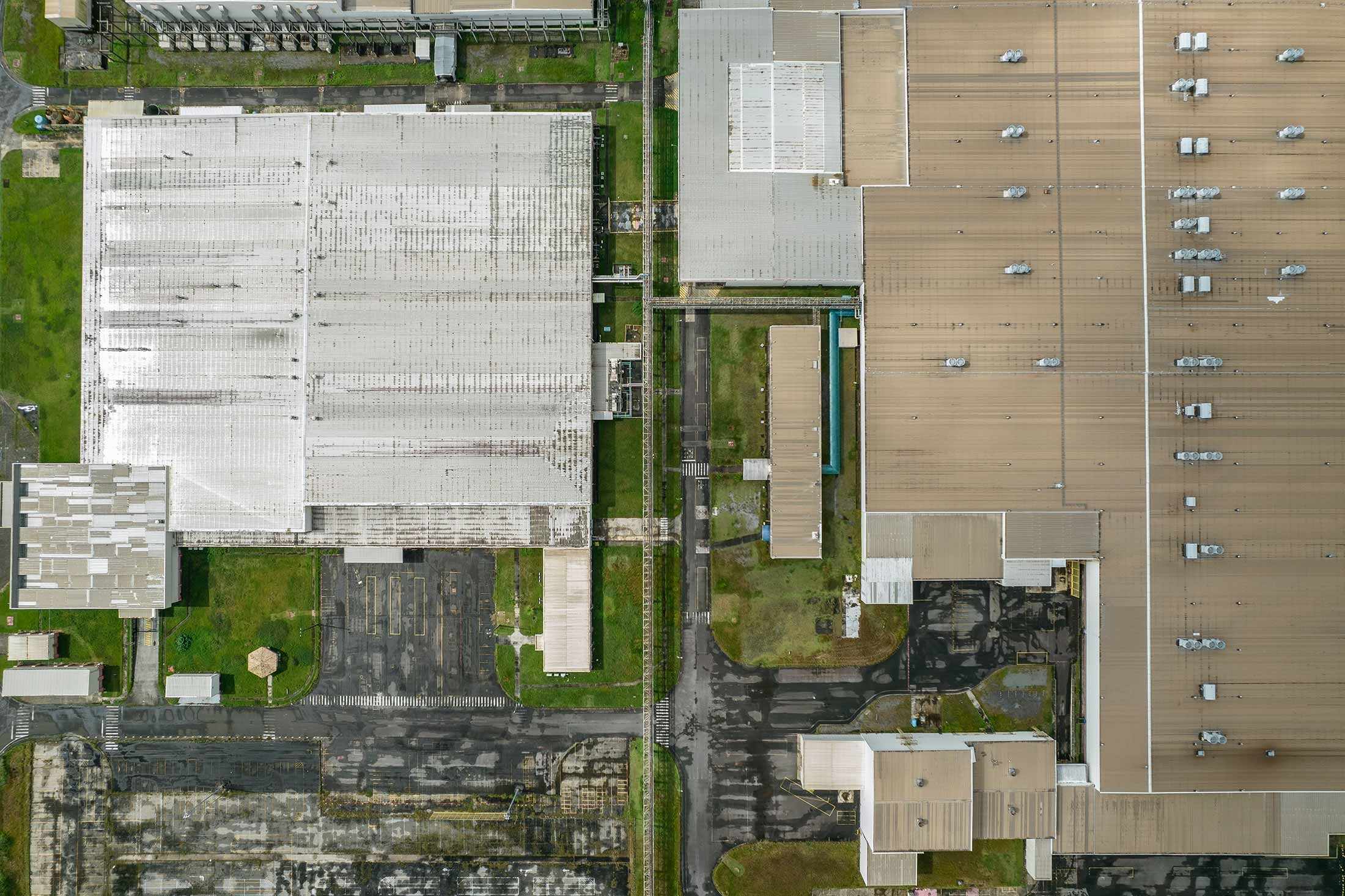

Tesla Slashes Prices For Model Y In China

Tesla Inc (TSLA.O) has cut prices in China for its Model Y starting today, 14 August. The car company dropped the starting prices of both models by 14,000 yuan (USD 1,934.58). The Model Y Long Range’s starting price drops by 4.5% to 299,900 yuan and the starting price of the Model Y Performance is now at 349,900 yuan, down by 3.8%.

SoftBank Attempts To Buy Vision Fund’s 25% Stake In Arm

SoftBank Group Corp (9984.T) is in talks to acquire the 25% stake in Arm Ltd it does not directly own from Vision Fund 1 (VF1), a USD 100 billion investment fund it raised in 2017, according to people familiar with the matter, potentially delivering a win for investors who have waited years for strong returns.

Anticipation Grows As China Stimulus Becomes More Apparent

Asian markets will get key economic signals this week that could determine monetary policies in various major sectors. House prices from China, Japanese GDP and inflation are also in the mix as the markets also will watch for interest rate decisions from New Zealand, Philippines, inflation figures from India and major corporate earnings reports from China.

Today’s News

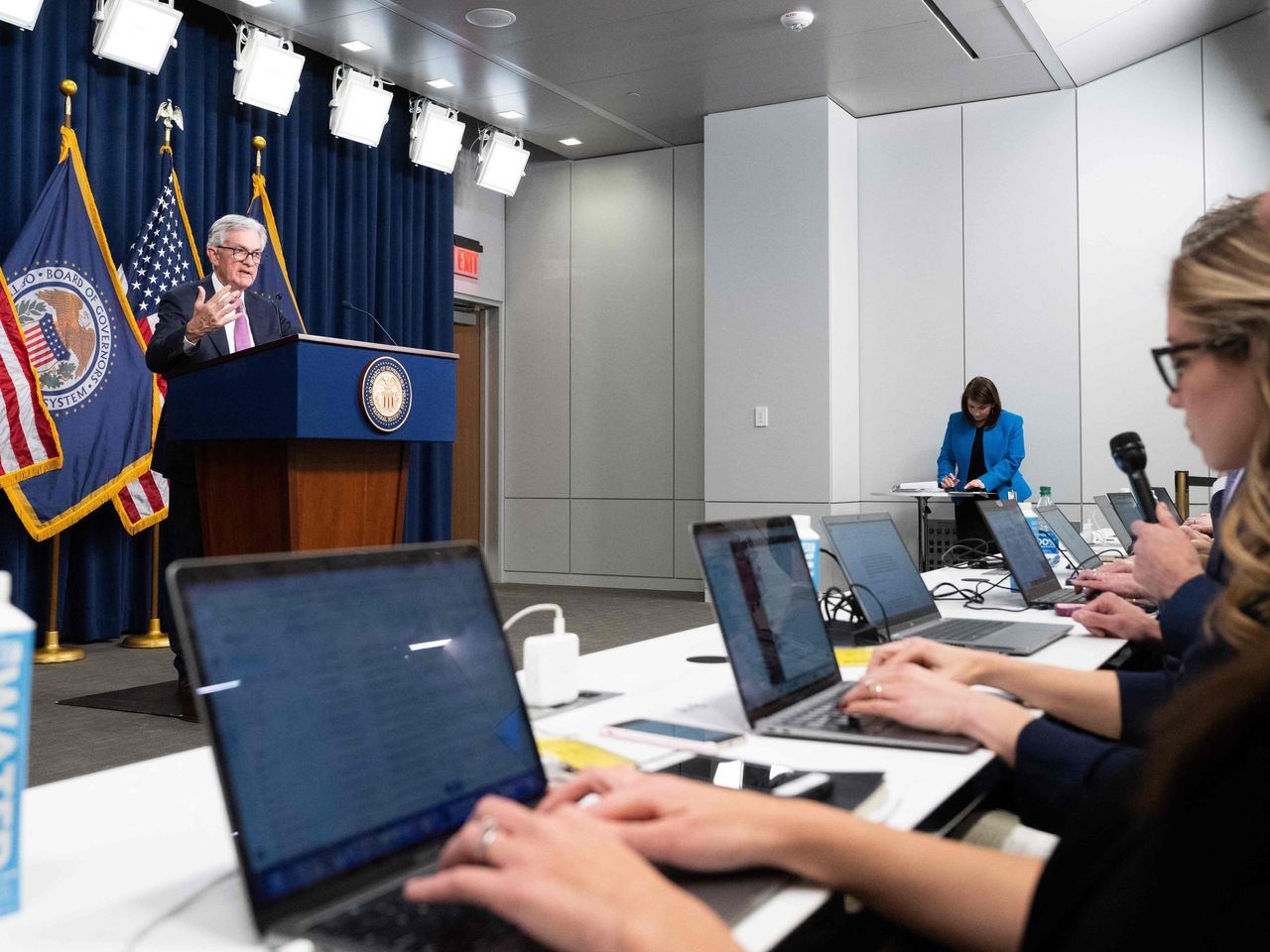

Economists and Fed experts are predicting that the U.S. will avert yet another recession, though it will be well into 2024 before anyone can be sure of it.

Fed Chair Jerome Powell says he expects the central bank to navigate a path where the U.S. economy expands with inflation rates falling back to the 2% target, though the task would pose many challenges.

On hindsight, failure to act aggressively enough against price pressures could also result in a rebounding inflation that requires harsher moves later. There’s also the risk that the lagged effects of what’s already the most aggressive tightening in four decades could tip the economy into recession as well.

The National Bureau of Economic Research’s business cycle committee, the official arbiter of U.S. downturns, defines a recession as a significant decline in economic activity that spreads across the economy, lasting for more than a few months on end. It is projected to take as long as 21 months to declare such an event, once the group processes what can be initially mixed reports and data revisions.

While there’s no formal definition of a soft landing, most economists see it as the moderation of inflation without a recession or serious harm to the labor market.

Other related news are as follows:

Goldman Economists Anticipate First Rate Cut Of 2024

Goldman Sachs Group Inc. economists anticipate the Federal Reserve will start lowering interest rates by the end of next June with a gradual, quarterly pace of reductions from that point till the new year.

“The cuts in our forecast are driven by this desire to normalize the funds rate from a restrictive level once inflation is closer to target,” Goldman economists including Jan Hatzius and David Mericle wrote in a note yesterday.

Goldman economists project rate cuts will happen within the second quarter of 2024 while the Wall Street bank expects no more hikes for the rest of the year.

U.S. Treads Along Moderate Inflation Path

U.S. inflation continued along a path of moderation that is bolstering prospects for an economic soft landing, while across the globe in China, consumer and producer prices fell in tandem.

The U.S. core consumer price index, a closely watched measure of underlying inflation, posted the smallest back-to-back advances since early 2021 and suggests that central bankers will hold off raising interest rates in the coming month.

Asian Equities Decline While Japanese Yen Surges Past Mighty Dollar

Asian equity benchmarks fell across Asia after Wall Street capped off a poor week on a down note while China’s worsening property slump continued to dampen market sentiment.

Stocks in Hong Kong fell approximately 2% at the open, with the shares of Country Garden Holdings Co. declined as much as 12%. The CSI 300 Index, which is the benchmark of onshore Chinese shares, extended its decline after capping its worst week since March on Friday amid signs of deterioration in the offshore yuan hovered near its weakest level for the year.