1. Forex Market Insight

EUR/USD

The euro closed down 0.87% against the dollar at 0.9772 on Wednesday, 19th October 2022. Europe economic risks continue to weigh on the euro.

Similar with most of the countries, Eurozone inflation soared as energy prices rise. While the supply chain, which still recovering from the outbreak, was further hit by the Russia-Ukraine conflict.

According to a new survey, most economists predict a 70% probability of the eurozone falling into recession within a year. For now, Eurozone inflation remain pressure as energy prices continue to soar.

With the Russian-Ukrainian conflict still a long way off, nearly 65% of the 34 respondents said the cost of living in the eurozone would worsen or significantly worsen. Only 12 said the situation would improve.

In addition, a number of European countries such as the United Kingdom, France and Italy have recently gone on strike to protest against rising prices. This situation has also caused a shock to the eurozone economy, becoming another major negative for the euro.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9770 and 0.9669. If the strength of EUR rise over the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

The pound closed down 0.92% against the dollar at 1.1217 on Wednesday, 19th October 2022. Earlier data showed that the consumer price indexof UK rose 10.1% in September. The increase in the cost of living jumped more than expected to a 40-year high set in July.

The market expects the pound to remain under pressure amid rising inflation and the prospect of a recession in the UK. Such a prospect could lead the Bank of England add 75 basis points in November but not the super-sized 100 bps.

While rate hikes usually boost a currency, in the case of the U.K., the focus is on the extent to which a rate hike will damage an already precarious economy.

Technical Analysis:

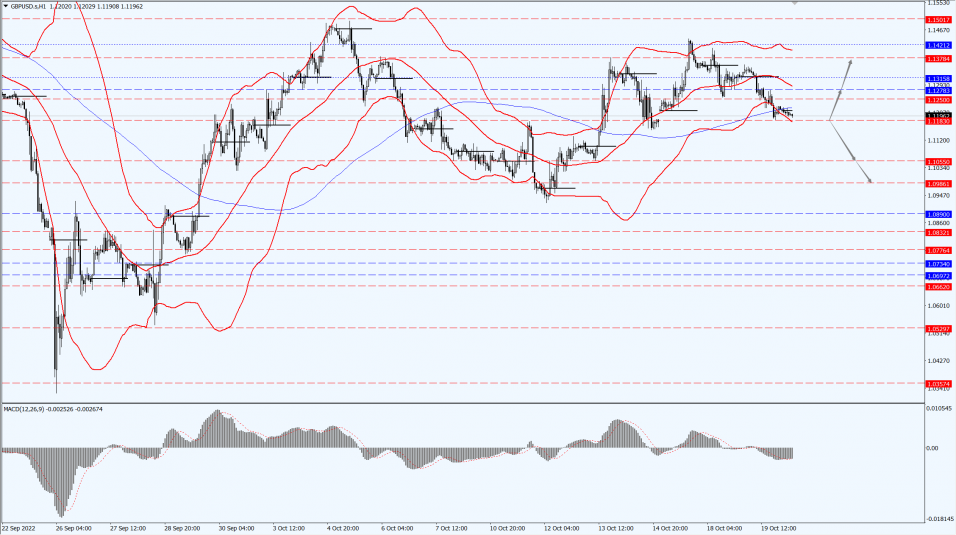

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1183-line today. If GBP runs below the 1.1183-line, it will pay attention to the suppression strength of the two positions of 1.1055 and 1.0986. If GBP runs above the 1.1183 -line, then pay attention to the suppression strength of the two positions of 1.1278 and 1.1378.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% to a three-week low Wednesday as the dollar and U.S. bond yields rose. The prospect of an aggressive Federal Reserve rate hike further weighed on the gold market.

Spot gold fell 1.5% to $1,627.81 an ounce after hitting its lowest point since 28 September 2002 earlier in the session.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1642-line today. If the gold price runs below the 1642-line, then it will pay attention to the support strength of the 1627 and 1Gold pays attention to the 1627-line today. If the gold price runs below the 1627-line, then it will pay attention to the support strength of the 1616 and 1594 positions. If the gold price breaks above the 1627-line, then pay attention to the suppression strength of the two positions of the 1642 and 1660.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rose on Wednesday, 19th October 2022, as caution over tightening supply countered the negative impact of uncertain demand, and news that the United States will release more crude from its reserves.

Biden, in remarks Wednesday, 19th October 2022, noted U.S. plans to repurchase oil for the reserve if prices fall enough. The reserve release would be the last sale from the planned sale of 180 million barrels of oil announced shortly after Russia invaded Ukraine in February.

Oil prices have recovered since the Organization of the Petroleum Exporting Countries (OPEC) agreed to reduce its production target by about 2 million barrels per day, although the actual reduction in production is expected to be about 1 million barrels.

U.S. crude inventories fell unexpectedly last week – down 1.7 million barrels, weekly government showed, against expectations for a build of 1.4 million barrels. SPR levels fell 3.6 million barrels to just over 405 million, the lowest since May 1984.

Technical Analysis:

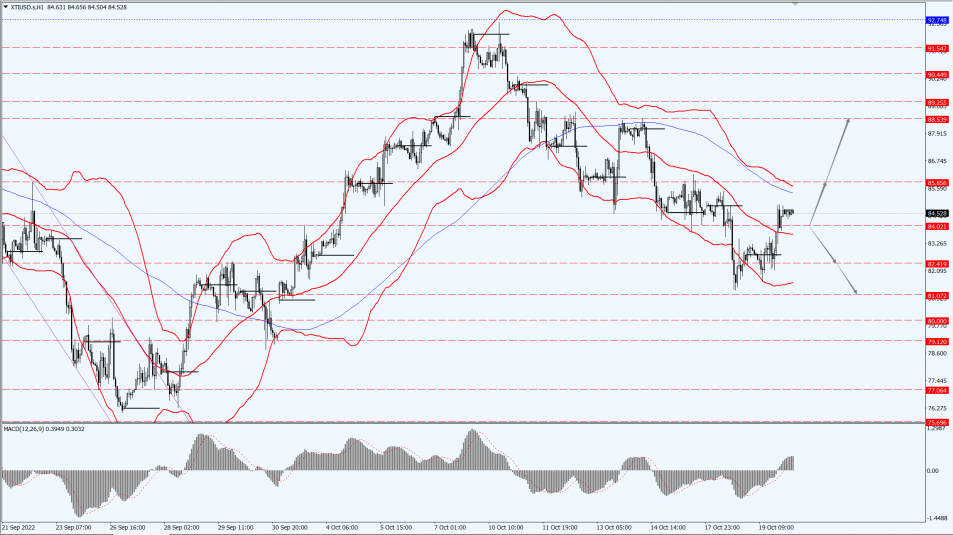

(Crude Oil 1-hour Chart)

Oil prices focus on the 84.02-line today. If the oil price runs above the 84.02-line, then focus on the suppression strength of the two positions of 85.85 and 88.53. If the oil price runs below the 84.02-line, then pay attention to the support strength of the two positions of 82.41 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.