1. Forex Market Insight

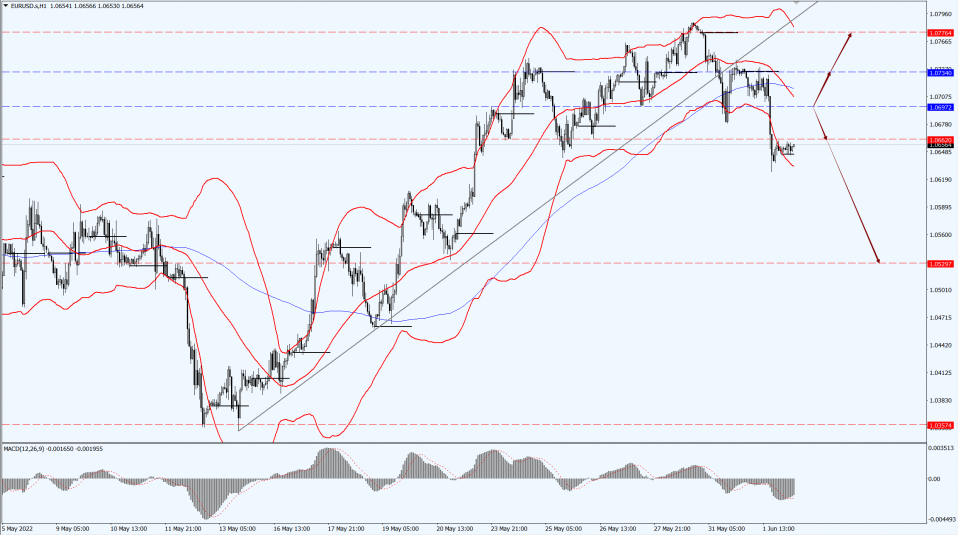

EUR/USD

EUR/USD fell 0.77% on Wednesday, 1st June 2022, hitting a new one-week low of 1.0626, extending Tuesday’s rally.

According to data released on Wednesday, 1st June 2022, U.S. manufacturing activity picked up in May.

Demand for commodities remains strong, which could ease fears of an imminent recession.

Additionally, the numbers of job openings in the U.S. declined in April, but remained at a very high level.

The favorable U.S. data put more pressure on EUR, which has been in a downward trend since Tuesday’s, 31st May 2022, release of inflation data, which hit a record high in the euro zone.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0697-line today. If EUR runs steadily above the 1.0697-line, then pay attention to the support strength of the two positions of 1.0734 and 1.0776. If the strength of EUR breaks below the 1.0697-line, then pay attention to the suppression strength of the two positions of 1.0662 and 1.0529.

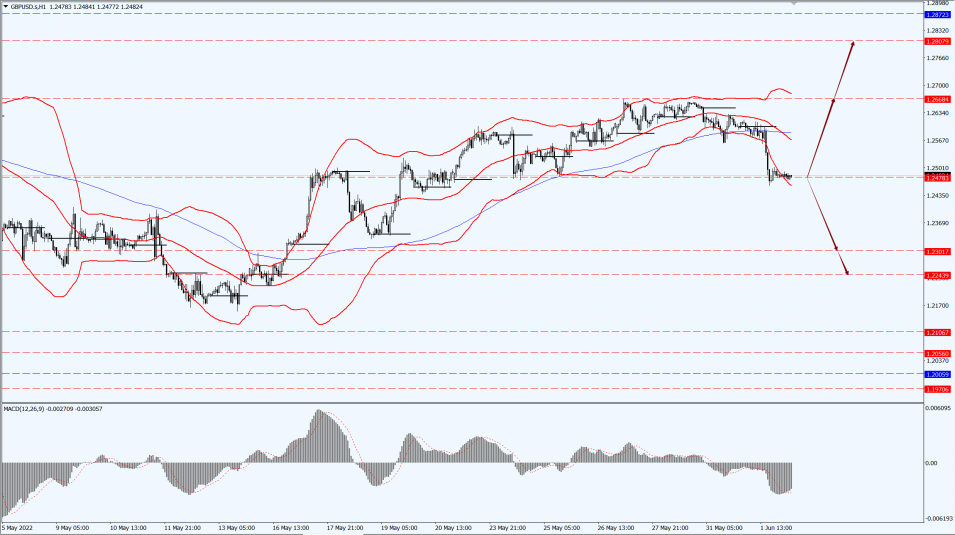

GBP Intraday Trend Analysis

Fundamental Analysis:

GBP fell about 0.9% on Wednesday, 1st June 2022, as investors worried about the deteriorating growth outlook for the United Kingdom.

A previous survey showed that U.K. manufacturing activity in May expanded at its slowest pace since January 2021.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2478-line today. If GBP runs below the 1.2478-line, it will pay attention to the suppression strength of the two positions of 1.2301 and 1.2243. If GBP runs above the 1.2478-line, then pay attention to the suppression strength of the two positions of 1.2668 and 1.2807.

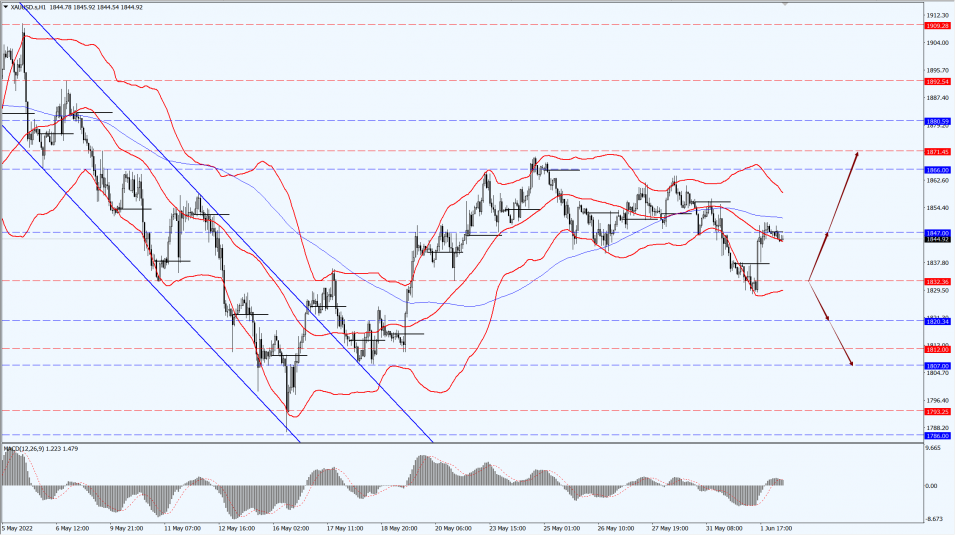

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices recovered from a two-week low yesterday, 1st June 2022.

Spot gold hit a high of $1,849.88 an ounce and closed at $1,846.20 an ounce, having hit a low of $1,827.80 earlier in the session, the lowest since 19th May 2022.

Investors turned their attention to safe-haven gold amid fears of rising inflation, mainly driven by higher fuel prices.

But a stronger dollar and rising U.S. Treasury yields limited gains.

U.S. gold futures settled 0.02% higher at $1,848.7 an ounce.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1832-line today. If the gold price runs steadily above the 1832-line, then it will pay attention to the support strength of the 1847 and 1871 positions. If the gold price breaks below the 1832-line, then pay attention to the suppression strength of the two positions of the 1820 and 1807.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices settled slightly higher on Wednesday, 1st June 2022.

This comes after EU leaders agreed to a phased ban on Russian oil imports and the end of the New Crown outbreak closure in Shanghai, Asia, which could boost already tight market demand.

Crude oil contracts have been steadily moving higher for several weeks due to reduced Russian exports as a result of EU and U.S. sanctions and limited purchases of Russian crude by India and China.

Russia is the world’s largest exporter of crude oil and fuel.

Brent crude futures settled at $116.29 a barrel, up $0.69, or 0.6%

U.S. crude futures settled at $115.26 a barrel, up 59 cents, or 0.5%.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs above the 111.95-line, then focus on the suppression strength of the two positions of 116.30 and 120.00. If the oil price runs below the 111.95-line, then pay attention to the support strength of the two positions of 109.62 and 107.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.