1. Forex Market Insight

The EUR/USD has increased 0.11% to 1.1027, having weakened over the past month as energy prices rose along with the escalated conflict in Ukraine.

ECB President Christine Lagarde said on Monday that the actions of the Federal Reserve and the ECB will be out of sync because the effects of the Ukraine war on their respective economies are very different.

But the ECB Governing Council member and French central bank governor Villeroy de Gallo said yesterday that the central bank needs to see through the short-term fluctuations in energy prices and pay attention to potential inflation trends.

Technical Analysis:

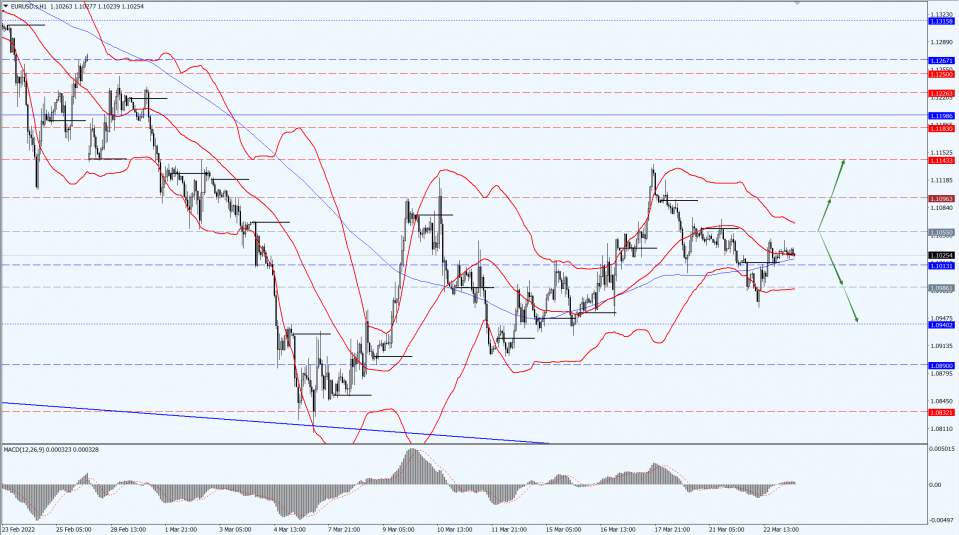

(EUR/USD 1-hour chart)

Execution Insight:

Today we focused on the 1.1055 line. If the euro runs steadily below the 1.1055-line, then pay attention to the support strength of the two positions of 1.0986 and 1.0940. If the strength of the euro breaks above the 1.1055-line, then pay attention to the suppression strength of the two positions of 1.1096 and 1.1143.

GBP Intraday Trend Analysis

GBP/USD rose 0.73% to 1.3261, with gilt yields higher.

Meanwhile, the focus of the day is the UK chancellor’s budget statement and Wednesday’s, 23rd March 2022, inflation figures.

Technical Analysis:

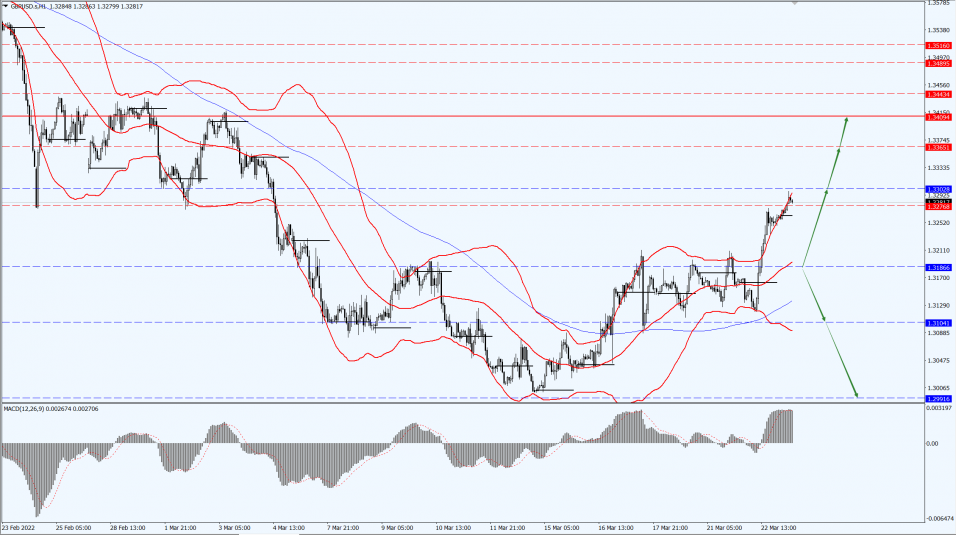

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.3186-line today. If the pound runs above the 1.3186-line, it will focus on the suppression strength of the 1.3302 and 1.3365 positions. If the pound runs below the 1.3186-line, it will focus on the support strength of the 1.3104 and 1.2991 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold fell yesterday. Spot gold once fell more than 1%, which refreshed a low of nearly four trading days to $1910.60 per ounce. At the same time, the U.S. Treasury yields rose after Federal Reserve Chairman Jerome Powell made hawkish comments on monetary policy.

Technical Analysis:

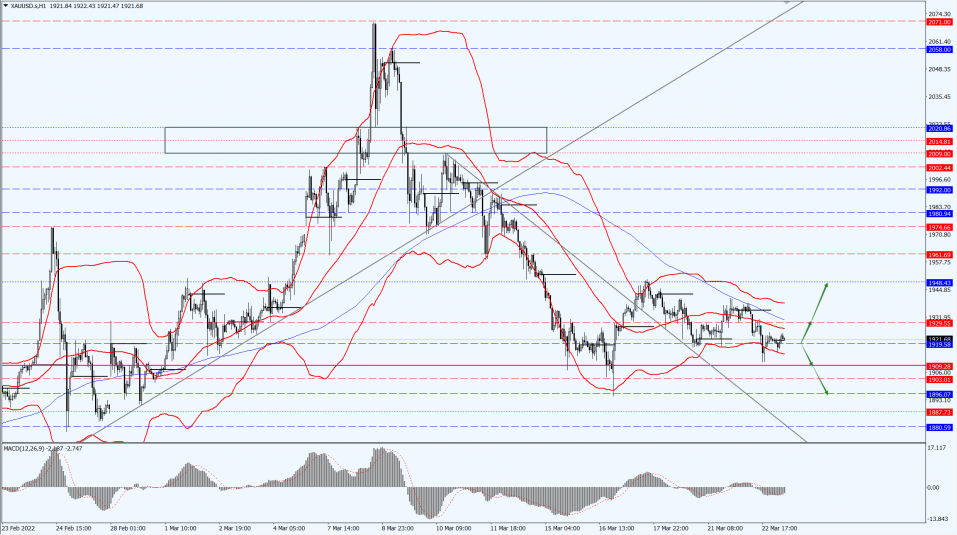

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1919-line today. If the gold price runs steadily above the 1919-line, then it will pay attention to the suppression of the 1929 and 1948 positions. If the gold price breaks below the 1919-line, it will open up further downside. At that time, we will pay attention to the support strength of the two positions of 1909 and 1896.

3. Commodities Market Insight

WTI Crude Oil

Oil prices fell in shock yesterday, with U.S. crude down more than 1% to $108.75 per barrel in late trade. This is due to the European Union discussed whether to ban Russian crude imports, but some major members remained opposed.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 107.52-line today. If the oil price runs above the 107.52-line, then focus on the suppression of the 111.95 and 116.30 positions. If the oil price runs below the 107.52-line, then pay attention to the support strength of 102.52 and 99.50.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.