1. Forex Market Insight

EUR/USD

The euro closed up 0.14% against the dollar at 0.9786 on Thursday, 20th October 2022. The virus, high inflation and ongoing strikes continue to weigh on the euro.

French unions has started a national strike on Tuesday, 18th October 2022, to demand higher wages for workers amid high inflation. This will be one of the toughest challenges faced by President Emmanuel Macron since his re-election in May.

The strike has already affected few key industries including rail and energy. It is also an extension of a week-long strike in the refining industry.

Several refineries of Total and ExxonMobil in France were recently forced to close due to strikes, leaving nearly a third of the country’s gas stations without fuel.

The general strike of oil refinery workers that caused difficulty in refueling has not yet subsided, and France has introduced a new round of strikes across the country.

In addition to the demand for higher wages to cope with inflation, the French people are also not satisfied with the recent French government’s order for forced recruitment of workers.

The situation in Europe will continue to deteriorate. All the economists had predicted a month ago that the eurozone economy will grow by 0.3% next year, and now the expected growth rate has went downhill to negative 0.1%.

Technical Analysis:

(EUR/USD 1-hour Chart)

We focus on the 0.9810 line today. If the EUR runs below the 0.9810 line, then pay attention to the support strength of the two positions of 0.9723 and 0.9669. If the strength of EUR rises over the 0.9810 line, then pay attention to the suppression strength of the two positions of 0.9852 and 0.9909.

GBP Intraday Trend Analysis

Fundamental Analysis:

Liz Truss said on Thursday, 20th October 2022 that she would resign as prime minister, brought down just 6 weeks into the job by an economic program that roiled financial markets, pushed up living costs for voters and enraged much of her own party.

The pound rallied before Truss announced his resignation and later touched an intraday high before reversing course to lower. The pound close up 0.16% against the dollar at 1.1235 on Thursday, 20th October 2022.

Technical Analysis:

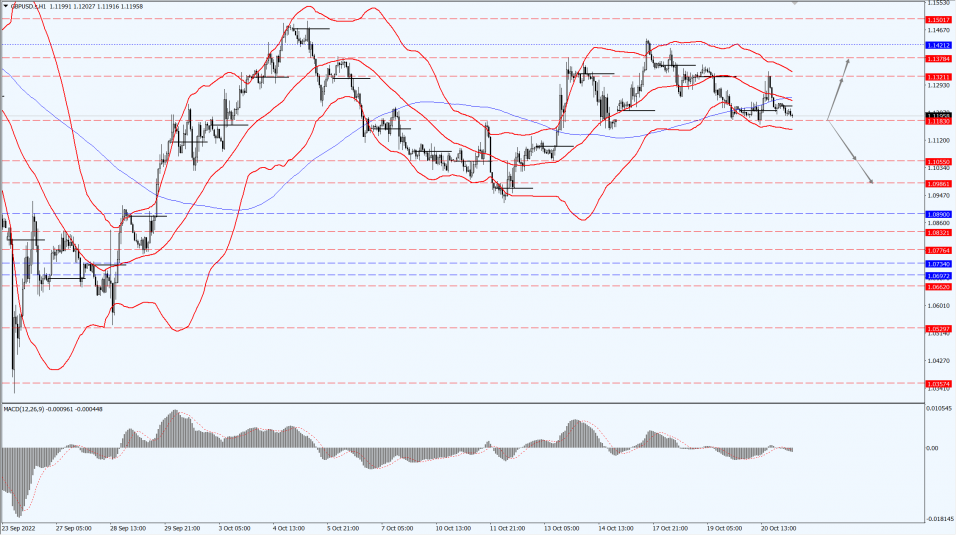

(GBP/USD 1-hour Chart)

GBP is mainly focused on the 1.1183-line today. If GBP runs below tGBP is mainly focused on the 1.1183 -line today. If GBP runs below the 1.1183 -line, it will pay attention to the suppression strength of the two positions of 1.1055 and 1.0986. If GBP runs above the 1.1183 -line, then pay attention to the suppression strength of the two positions of 1.1321 and 1.1378.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold pared gains on Thursday, 20th October 2022, after rising about 1% on a weaker dollar, as a jump in stocks and a recovery in U.S. bond yields dragged the precious metal back toward a three-week low hit earlier.

Spot gold rose 0.1% to $1,629.75 an ounce, having earlier hit its lowest since late September.

Technical Analysis:

(Gold 1-hour Chart)

Gold pays attention to the 1627-line today. If the gold price runs below the 1627-line, then it will pay attention to the support strength of the 1616 and 1594 positions. If the gold price breaks above the 1627-line, then pay attention to the suppression strength of the two positions of the 1645 and 1660.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices were near flat during a choppy trading session on Thursday, 20th October 2022 as worries about inflation dampening demand for oil contended with news that China is considering easing COVID-19 quarantine measures for visitors.

A looming European Union ban on Russian crude and oil products, as well as the output cut from the Organization of the Petroleum Exporting Countries and allies including Russia, known as OPEC+, have supported prices recently. OPEC+ agreed on a production cut of 2 million barrels per day in early October.

Meanwhile, US President Joe Biden has announced his plan on Wednesday, 19th October 2022 to sell off the rest of the release from the nation’s Strategic Petroleum Reserve (SPR) by year’s end, or 15 million barrels of oil, and begin refilling the stockpile as he tries to dampen high gasoline prices ahead of midterm elections on 8th November 2022.

However, the announcement has failed to ease oil prices, as official US data showed that the SPR last week dropped to their lowest since mid-1984, while commercial oil stocks fell unexpectedly.

Technical Analysis:

(Crude Oil 1-hour Chart)

Oil prices focus on the 83.80 line today. If the oil price runs above the 83.80-line, then focus on the suppression strength of the two positions of 85.19 and 86.77. If the oil price runs below the 83.80-line, then pay attention to the support strength of the two positions of 81.81 and 81.07.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.