1. Forex Market Insight

EUR/USD

The ECB does not intend to raise interest rates in the near future. However, flexibility is needed to achieve the ECB’s medium-term inflation target. Thus, this is the main reason for the recent upward pressure on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

Today, pay attention to the suppression of the 1.1338-line. If the euro runs stably below the 1.1338-line, then pay attention to the support at 1.1226 and 1.1198 below. If the euro breaks through the 1.1338-line, then pay attention to the suppression at 1.1359 and 1.1378.

GBP Intraday Trend Analysis

Fundamental Analysis:

Improved global risk appetite has pushed the pound higher against the dollar, despite British Prime Minister Johnson’s warning that further lockdown measures may be needed to counter the spread of the virus.

The pound reversed its two-day losing streak and rose by 0.4 percent to 1.3261, its highest level since Friday and its biggest gain since Thursday.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound today is mainly focused on the 1.3302-line. If the pound runs below the 1.3302-line, then pay attention to the support of the 1.3186-line. If the pound strength rises above the 1.3302-line, then pay attention to the suppression of the 1.3365 and 1.3409 positions.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices surged lower yesterday as market concerns over Omicron eased, while strong gains in U.S. bond yields and equities pressured gold prices.

However, potential pandemic concerns and a continued weaker dollar remained supportive towards gold. Intraday, focus on the final U.S. GDP for the third quarter and the U.S. Conference Board Consumer Confidence Index.

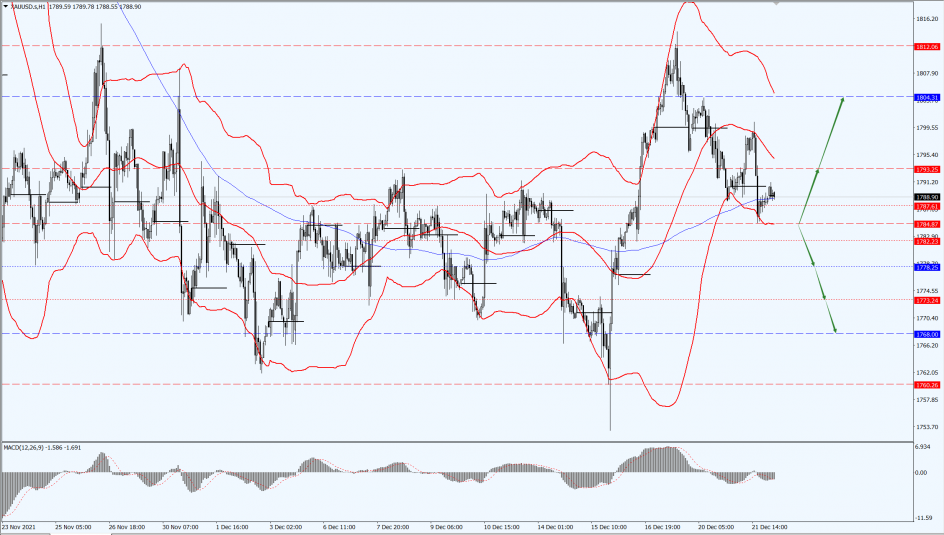

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Today, gold pays attention to the 1784-line. If the price of gold runs stably above the 1784-line, then pay attention to the suppression of the 1793 and 1804 positions. If the gold price breaks below the 1784-line, it will open up a further downside space. At that time, pay attention to the strength of support for each position at 1778 and 1768.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices rebounded yesterday, with U.S. oil up by nearly 3%, as the market resumed buying risk assets after two days of big losses and news of a Covid-19 oral drug boosted the rally.

However, investors remained cautious as the Omicron variant cut holiday travel plans. Intraday, focus on the final value of the U.S. GDP price index for the third quarter, the U.S. Conference Board consumer confidence index for December, and EIA data.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Today, oil prices pay attention to the 69.37-line. If oil prices run above the 69.37-line, then pay attention to the suppression at the 72.77 and 73.52 positions. If the oil price falls below the 69.37-line, then pay attention to the support at the 68.57 and 66.33 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.