1. Forex Market Insight

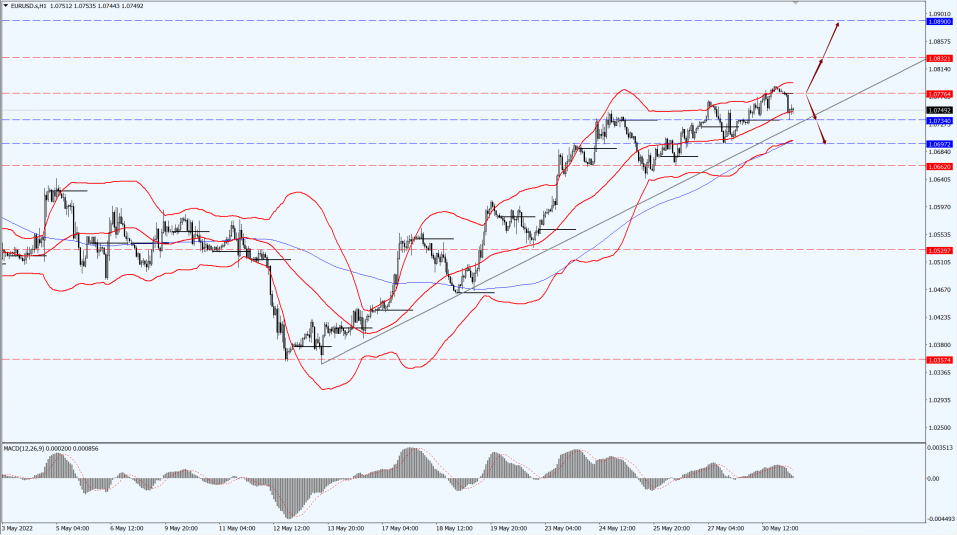

EUR/USD

According to the inflation data released in Germany and Spain on Monday, 30th May 2022, prices accelerated in May due to soaring energy prices.

Eurozone inflation data will be released on Tuesday, 31st May 2022.

Although inflation data dampened the euro’s rally, the euro was still up 0.4% at $1.0774 on Monday, 30th May 2022.

It had previously touched a monthly high of $1.0786.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0776-line today. If EUR runs steadily above the 1.0776-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0890. If the strength of EUR breaks below the 1.0776-line, then pay attention to the suppression strength of the two positions of 1.0734 and 1.0697.

GBP Intraday Trend Analysis

Fundamental Analysis:

The UK government is expected to provide more financial support to UK households by the end of the current financial year (until April 2023).

The package introduced last week set a precedent for government support to vulnerable families.

Following the current continued strain on household incomes, a further scheme of between £5 billion and £10 billion is likely to be introduced.

If the risk of continued inflation abates, the UK government is expected to cut VAT in the fourth quarter, as well as implementing permanent tax cuts from April 2023 to stimulate the economy.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.2668-line today. If GBP runs below the 1.2668-line, it will pay attention to the suppression strength of the two positions of 1.2478 and 1.2301. If GBP runs above the 1.2668-line, then pay attention to the suppression strength of the two positions of 1.2807 and 1.2872.

2. Precious Metals Market Insight

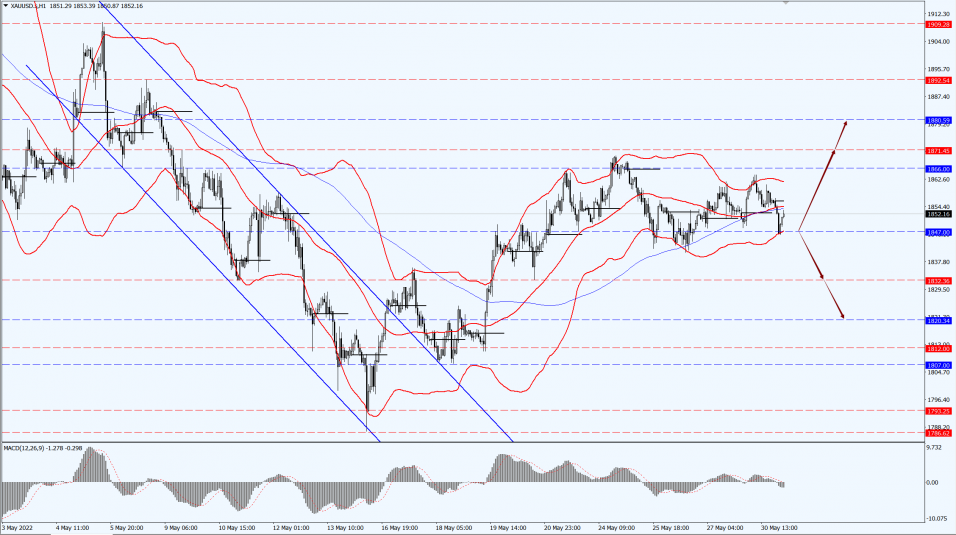

Gold

Fundamental Analysis:

Gold prices held firm on Monday, 30th May 2022, trading trapped in the 1848-1864 range, driven by the depreciation of the dollar, while the market reduced expectations for further aggressive tightening of monetary policy in the United States.

U.S. gold futures were up 0.04% at $1,858.

The U.S. dollar index touched a more than one-month low, making gold prices a bit lower for markets holding other currencies.

The 10-year U.S. bond yield closed on Friday, 27th May 2022, at a level slightly above a six-week low.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1847-line today. If the gold price runs steadily below the 1847-line, then it will pay attention to the support strength of the 1871 and 1880 positions. If the gold price breaks above the 1847-line, then pay attention to the suppression strength of the two positions of the 1832 and 1820.

3. Commodities Market Insight

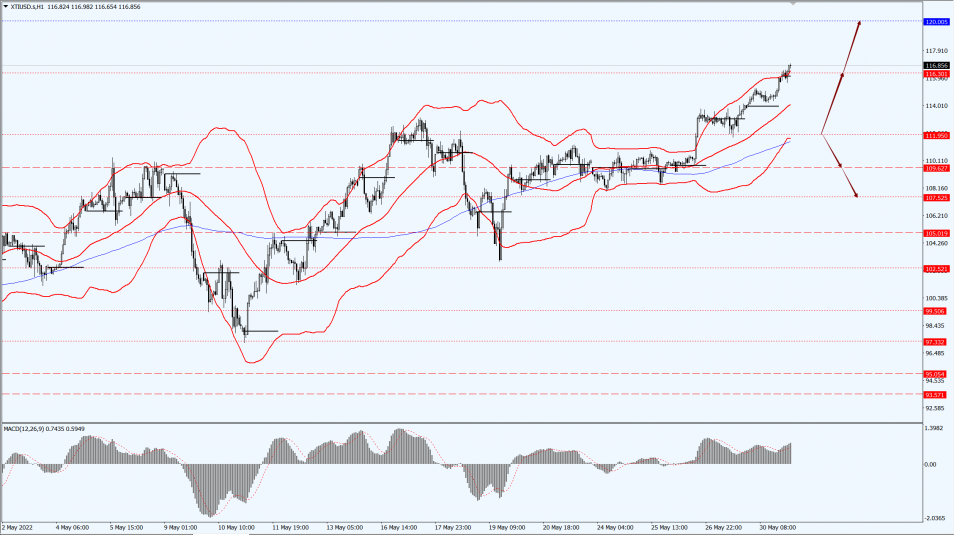

WTI Crude Oil

Fundamental Analysis:

As Asia eases coronavirus lockdowns and traders digest expectations that the European Union will eventually agree on a ban on Russian oil imports, brent crude climbed above $120 a barrel on Monday, 30th May 2022, hitting a two-month high of $122.01 a barrel.

Technical Analysis:

(Crude Oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 111.95-line today. If the oil price runs below the 111.95-line, then focus on the suppression strength of the two positions of 116.30 and 120.00. If the oil price runs above the 111.95-line, then pay attention to the support strength of the two positions of 109.62 and 107.52.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.