1. Forex Market Insight

EUR/USD

Macron was re-elected as the President of France. However, this result can only provide a temporary respite for the Euro as this result is conducive to further integration of the EU in the future, pushing the EU to finance a joint fiscal stimulus package to mitigate the negative impact of the Russo-Ukrainian war on the European economy.

French President Macron may have the temerity to continue pushing for a stronger response to Russia. One of the main downside risks to the European economy in the coming months is tougher measures, including restrictions on Russian energy exports to the EU.

Accordingly, the re-election of Macron by itself is clearly not enough to reserve the current bearish trend for the Euro.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0776-line today. If the euro runs steadily below the 1.0776-line, then pay attention to the support strength of the two positions of 1.0697 and 1.0529. If the strength of the euro breaks above the 1.0776-line, then pay attention to the suppression strength of the two positions of 1.0832 and 1.0890.

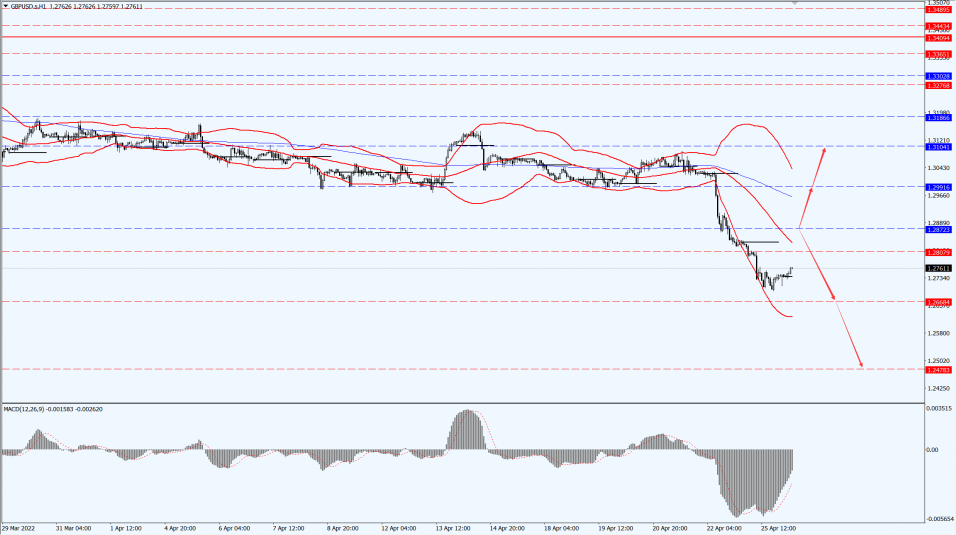

GBP Intraday Trend Analysis

Fundamental Analysis:

In the past week, GBP/USD resumed its decline and fell below the 1.30 round figure mark, expecting the pound to be more vulnerable to a further sudden slowdown in the UK economy and poor financial market conditions.

The policy divergence between the Bank of England and the Federal Reserve is expected to become more pronounced in the coming months. Additionally, there is growing evidence of a more abrupt slowdown in the UK economy, which will make the Bank of England more cautious about raising interest rates, while the Fed is now more determined to raise interest rates earlier.

Other than that, investors are increasingly concerned about the negative impact of aggressive policy tightening on global financial conditions and the global economy, and the pound is expected to be more negatively affected than the dollar.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2872-line today. If the pound runs below the 1.2872-line, it will pay attention to the suppression strength of the two positions of 1.2668 and 1.2478. If the pound runs below the 1.2872-line, then pay attention to the support strength of the two positions of 1.2991 and 1.3104.

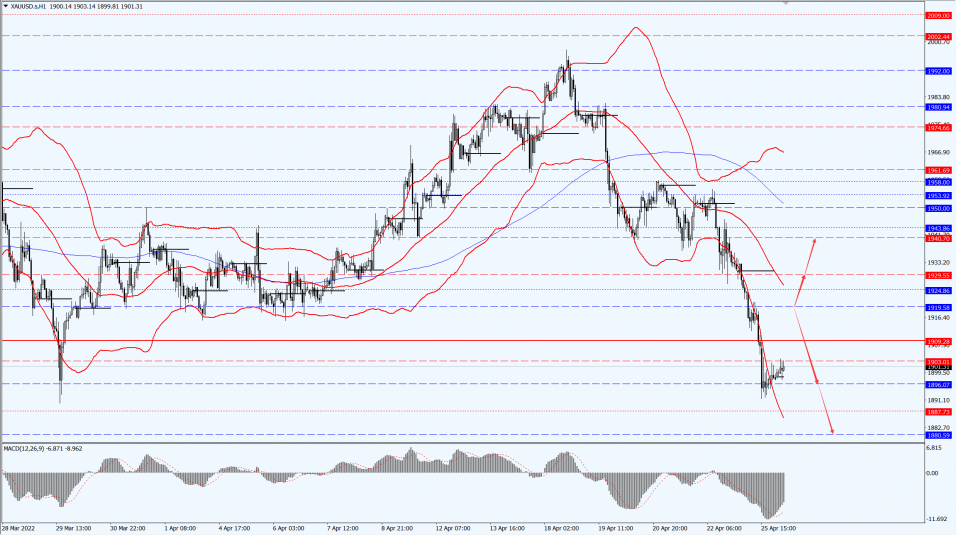

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices plunged yesterday, 25th April 2022. Spot gold once fell more than 2%, hitting a new low since March 29 to $1891.30 per ounce. After a series of hawkish statements made by Fed officials, the market now expects the Fed to raise interest rates sharply this year in order to control inflation, which puts gold prices under pressure.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1919-line today. If the gold price runs steadily below the 1919-line, then it will pay attention to the support strength of the 1896 and 1880 positions. If the gold price breaks above the 1940-line, then pay attention to the suppression strength of the two positions of the 1929-line and 1940-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

U.S. oil fell more than 3% in late trading, and fell more than 6% during the session, hitting a two-week low, amid growing concerns about the outlook for global energy demand due to prolonged lockdown measures in some regions and a possible U.S. interest rate hike.

Both the U.S. oil and the Brent oil hit their lowest closing levels since 11th April 2022, and fell nearly 5% last week. It has plunged about 25% since surging to its highest level since 2008 in early March. This led U.S. speculators to cut their net long futures and options positions last week to their lowest levels since April 2020.

Also weighing on oil prices, the dollar rose to a two-year high against a basket of currencies, boosted by the prospect of sharp U.S. interest rate hikes. A strong dollar makes oil more expensive for holders of other currencies.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 95.05-line today. If the oil price runs above the 95.05-line, then focus on the suppression strength of the 99.50 and 102.52 positions. If the oil price runs below the 95.05-line, then pay attention to the support strength of the 93.57 and 90.44 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.