The euro continued to fall on Monday, 10 October 2022, with the euro closing down 0.43% against the dollar at 0.9696.

Any measures that might dampen the economic effects of high energy costs this winter could support the euro, said economists at Commerzbank.

What is important for the euro is not that a single member state decides on effective aid measures, but that the entire currency area has support measures in place.

In this context, there seems to be a conflict at the EU level as to which measures to implement, which seems to be problematic.

Economists at Commerzbank warned that the threat of an energy crisis could continue to put pressure on the euro.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 0.9701-line today. If EUR runs steadily below the 0.9701-line, then pay attention to the support strength of the two positions of 0.9641 and 0.9559. If the strength of EUR breaks above the 0.9701-line, then pay attention to the suppression strength of the two positions of 0.9770 and 0.9810.

GBP Intraday Trend Analysis

Fundamental Analysis:

In the U.K., the Bank of England tried to ease concerns about the end of its emergency bond-buying program.

UK markets were thrown into turmoil in late September after the government unveiled a plan to cut taxes and increase borrowing.

The pound plunged and the Bank of England was forced to intervene to shore up the bond market.

The Bank of England said it was prepared to buy up to 10 billion pounds ($11.07 billion) of British government bonds on Monday, 10 October 2022, double the previous limit.

The central bank has also created a new program to help make cash more readily available to banks.

Despite this series of moves by the Bank of England, GBP/USD slipped for the fourth consecutive session, closing down 0.28% at 1.1054 on Monday, 10 October 2022, though still well above the all-time low of 1.0356 touched on 26th Sep 2022.

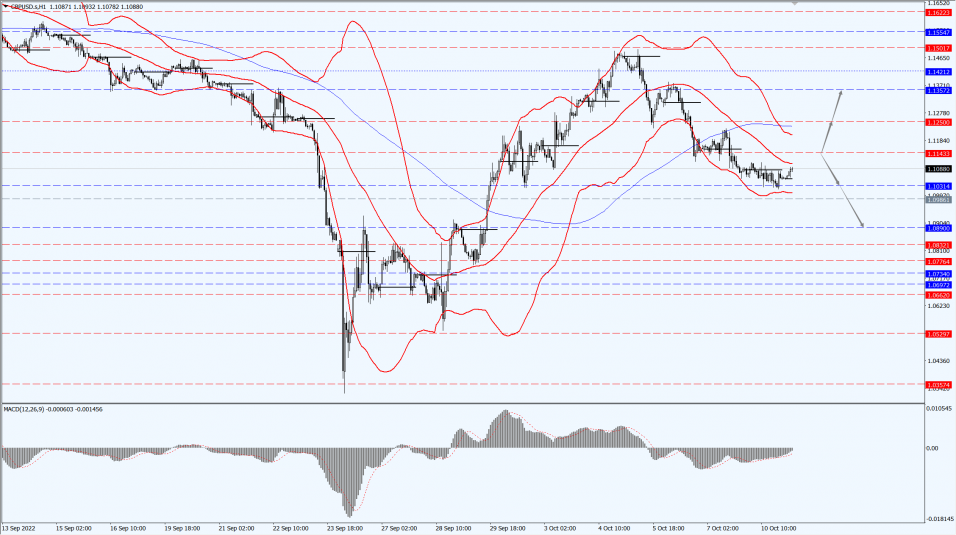

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1143-line today. If GBP runs below the 1.1143-line, it will pay attention to the suppression strength of the two positions of 1.1031 and 1.0890. If GBP runs above the 1.1143-line, then pay attention to the suppression strength of the two positions of 1.1250 and 1.1357.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell more than 1% on Monday, 10 October 2022, as a rising dollar and consolidation of bets that the Federal Reserve will be aggressive in raising interest rates caused non-interest-bearing gold to hit a one-week low.

Gold has fallen for a fourth straight session, possibly the worst stretch of movement since mid-August.

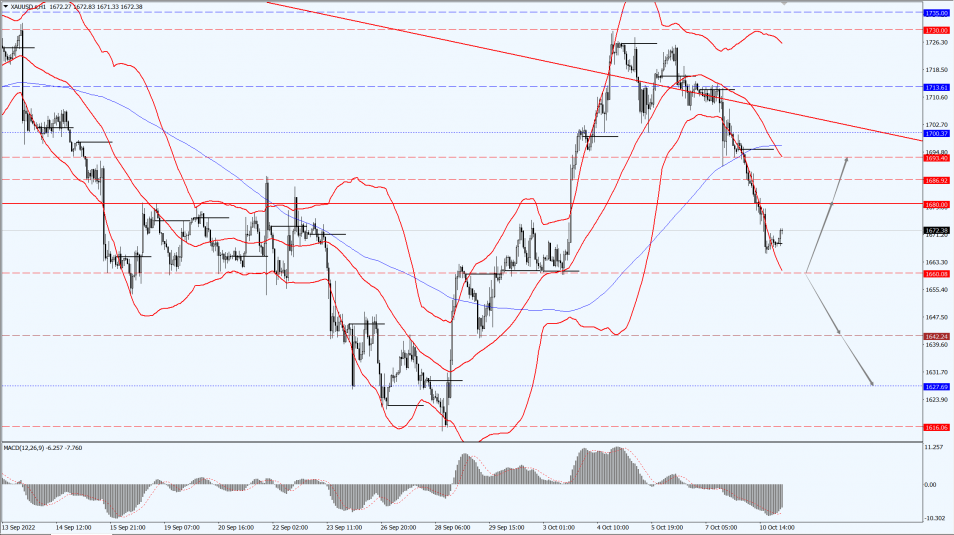

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1660-line today. If the gold price runs steadily below the 1660-line, then it will pay attention to the support strength of the 1642 and 1627 positions. If the gold price breaks above the 1660-line, then pay attention to the suppression strength of the two positions of the 1680 and 1693.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell nearly 2% on Monday, 10 October 2022, ending a five-session run of gains, as investors worried that economic clouds could herald a global recession and hit fuel demand.

Both major indicator crude futures have risen over the past week, largely on expectations that global supplies will tighten.

Oil prices fell as Federal Reserve officials made statements about rising interest rates and the impact on the economy.

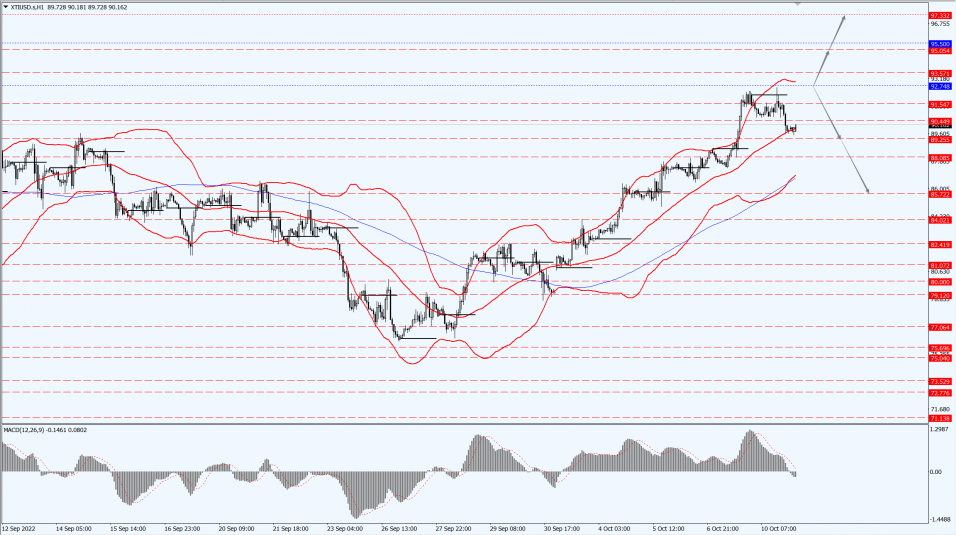

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 92.74-line today. If the oil price runs above the 92.74-line, then focus on the suppression strength of the two positions of 95.05 and 97.33. If the oil price runs below the 92.74-line, then pay attention to the support strength of the two positions of 89.25 and 85.72.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.