1. Forex Market Insight

EUR/USD

Due to the mild weakness of the US dollar, the EUR/USD saw a small rebound yesterday, 20th April 2022, rising 0.68% for the day to finally close at 1.0855.

A 10% rise in the yield on Germany’s 10-year bond, the euro zone’s benchmark, kept the euro resilient against its main rival. Meanwhile, the yield on the 10-year Treasury Inflation-Protected Securities (TIPS) broke into positive territory for the first time in more than two years during Asian trading yesterday, 20th April 2022.

A development suggests that the rally in U.S. Treasury yields may be nearing an end, making it more difficult for the dollar to move higher. Changes in fundamentals may give EUR/USD the opportunity to extend the rally in the short term.

Technical Analysis:

(EUR/USD 1-hour chart)

Execution Insight:

We focus on the 1.0776-line today. If the euro runs steadily above the 1.0776-line, then pay attention to the support strength of the two positions of 1.0832 and 1.0890. If the strength of the euro breaks below the 1.0776-line, then pay attention to the suppression strength of the two positions of 1.0734 and 1.0697.

GBP Intraday Trend Analysis

GBP/USD rebounded slightly, barely holding the 1.30 mark. Recently, the unstable situation in the West has continued to provide the US dollar with a safe-haven demand. In addition, the Fed’s strong interest rate hike expectations have once again provided a buying order for the US dollar, for which the pound is also deeply suppressed.

As for the policy adjustment of the Bank of England, the market strongly hope that UK will also raise interest rates by 50 basis points like New Zealand, Canada and the United States, moreover, to increase the tightening measures. However, the recent soft hike stanced by the Bank of England has reduced market expectations of a 50 basis point rate hike by the Bank of England.

Although it is said that the current inflation rate in the UK has reached 7%, it still depends on the statement made by Bailey, the governor of the Bank of England, on top of what decision should be made for the next monetary policy. This will determine the choice of the next trend of the pound.

Technical Analysis:

(GBP/USD 1-hour chart)

Execution Insight:

The pound is mainly focused on the 1.2991-line today. If the pound runs above the 1.2991-line, it will pay attention to the suppression strength of the two positions of 1.3104 and 1.3186. If the pound runs below the 1.2991-line, then pay attention to the support strength of the 1.2872-line.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold bottomed out and rebounded yesterday, 20th April 2022, as the Fed’s Beige Book indicated that U.S. companies were being hit by a double whammy of labor shortages and high inflation, while data showed U.S. home sales continued to fall in March and hit a nearly two-year low.

The dollar index pulled back sharply, coupled with Russia striking dozens of military facilities, the US announced a new round of sanctions against Russia. The demand for safe-haven purchases rebounded, providing support for the price of gold.

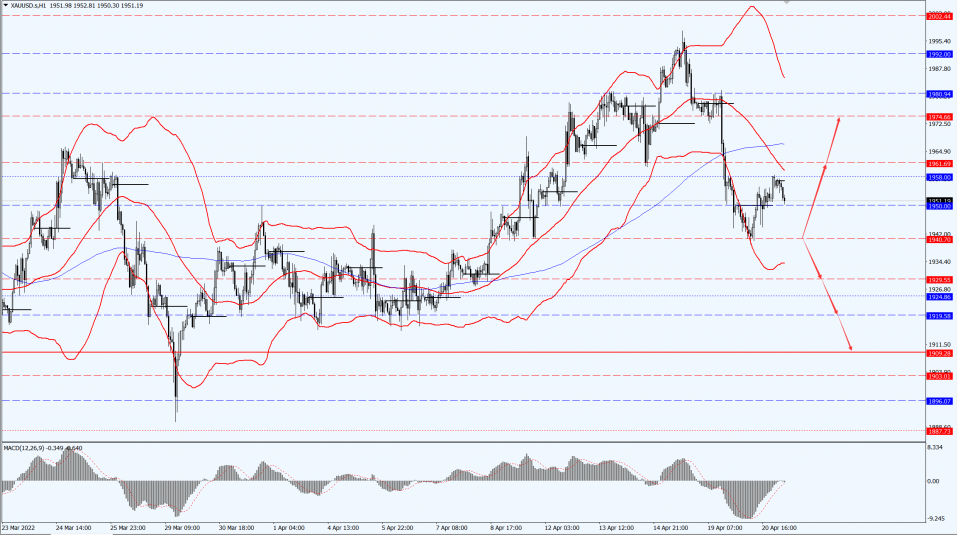

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1948-line today. If the gold price runs steadily above the 1948-line, then it will pay attention to the support strength of the 1961 and 1974 positions. If the gold price breaks below the 1940-line, then pay attention to the suppression strength of the two positions of the 1929-line and 1919-line.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Brent oil futures rose 0.4% to settle at $106.8 a barrel yesterday, 20th April 2022. The inventory report released by the U.S. Energy Information Administration (EIA) earlier showed that gasoline inventories fell by 761,000 barrels in the week ended 15th April 2022, refined oil inventories fell by 2.664 million barrels.

Crude oil exports increased by 2.09 million barrels per day to 4.27 million barrels per day, the highest since the week of 13th March 2020. Commercial crude oil imports excluding strategic reserves last week were 5.837 million barrels per day, the lowest since April 2021, a decrease of 158,000 barrels per day from the previous week.

The four-week average supply of U.S. crude products was 19.373 million barrels per day, down 1.5% from last year.

Technical Analysis:

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 99.50-line today. If the oil price runs above the 99.50-line, then focus on the suppression strength of the 102.52 and 107.52 positions. If the oil price runs below the 99.50-line, then pay attention to the support strength of the 97.33 and 95.05 positions.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.