1. Forex Market Insight

EUR/USD

USD rose to a new 20-year high on Wednesday, 6th July 2022, while EUR fell to a new 20-year low.

Rising energy prices cast a shadow over the euro zone economy, but boosted the dollar’s safe-haven appeal.

Technical Analysis:

(EUR/USD 1-hour chart)

We focus on the 1.0184-line today. If EUR runs steadily below the 1.0184-line, then pay attention to the support strength of the two positions of 1.0017 and 0.9924. If the strength of EUR breaks above the 1.0184-line, then pay attention to the suppression strength of the two positions of 1.0357 and 1.0529.

GBP Intraday Trend Analysis

Fundamental Analysis:

As political turmoil in the U.K. exacerbated pressure on markets already battered by economic uncertainty.

The $3.6 billion iShares MSCI UK exchange-traded fund (symbol EWU) had the highest put/call ratio based on options volume as of July 1, according to available data.

This indicator measures the number of long and short traders.

EWU’s major holdings, which include giants such as AstraZeneca, Shell and HSBC Holdings, have fallen for six straight days, the longest losing streak since February 2020.

Technical Analysis:

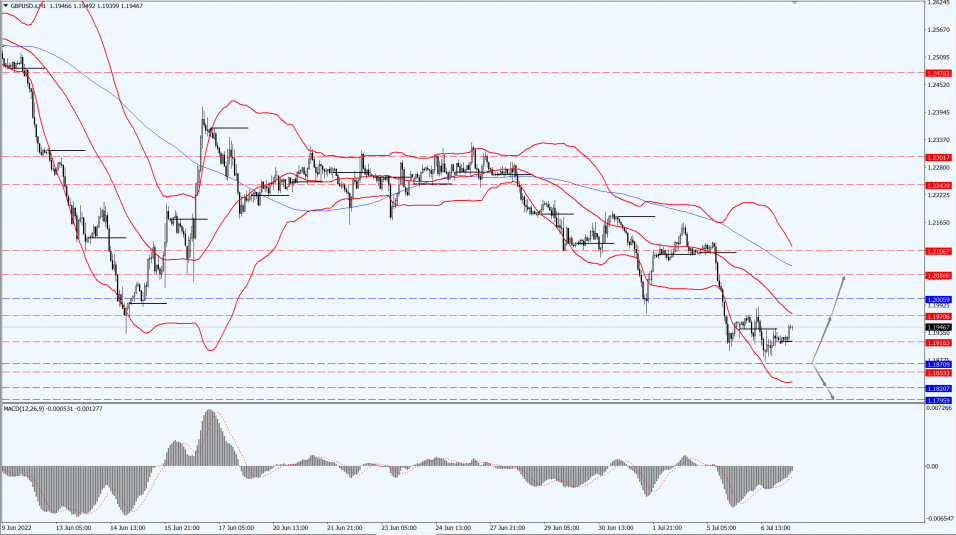

(GBP/USD 1-hour chart)

Execution Insight:

GBP is mainly focused on the 1.1870-line today. If GBP runs below the 1.1870-line, it will pay attention to the suppression strength of the two positions of 1.1820 and 1.1795. If GBP runs above the 1.1870-line, then pay attention to the suppression strength of the two positions of 1.1920 and 1.2056.

2. Precious Metals Market Insight

Gold

Fundamental Analysis:

Gold prices fell 1.8% on Wednesday, 6th July 2022, to hit a more than nine-month low.

As the dollar jumped to its highest since March 2020, investors are treating it as a safe-haven asset as recession fears grow and the Federal Reserve continues to raise interest rates.

And as central banks around the world are tightening monetary policy to combat inflation, investors fear an economic downturn is on the horizon.

The possibility that the Federal Reserve will raise interest rates faster than peers such as the European Central Bank also further boosted the dollar.

Gold is heading for its biggest weekly drop since June 2021.

Technical Analysis:

(Gold 1-hour chart)

Trading Strategies:

Gold pays attention to the 1740-line today. If the gold price runs steadily below the 1740-line, then it will pay attention to the support strength of the 1760 and 1783 positions. If the gold price breaks above the 1740-line, then pay attention to the suppression strength of the two positions of the 1760 and 1783.

3. Commodities Market Insight

WTI Crude Oil

Fundamental Analysis:

Oil prices fell about 2% in choppy trading on Wednesday, 7th July 2022, hitting a 12-week low, extending the previous session’s sharp losses.

That’s because investors are increasingly concerned that energy demand will take a hit in a possible global recession.

API data released in the morning showed that U.S. crude oil inventories increased last week, while refined oil stocks decreased.

Crude oil inventories increased by about 3.8 million barrels in the week ended 1st July 2022.

Oil stocks decreased by 1.8 million barrels and distillate stocks decreased by about 635,000 barrels.

Technical Analysis:

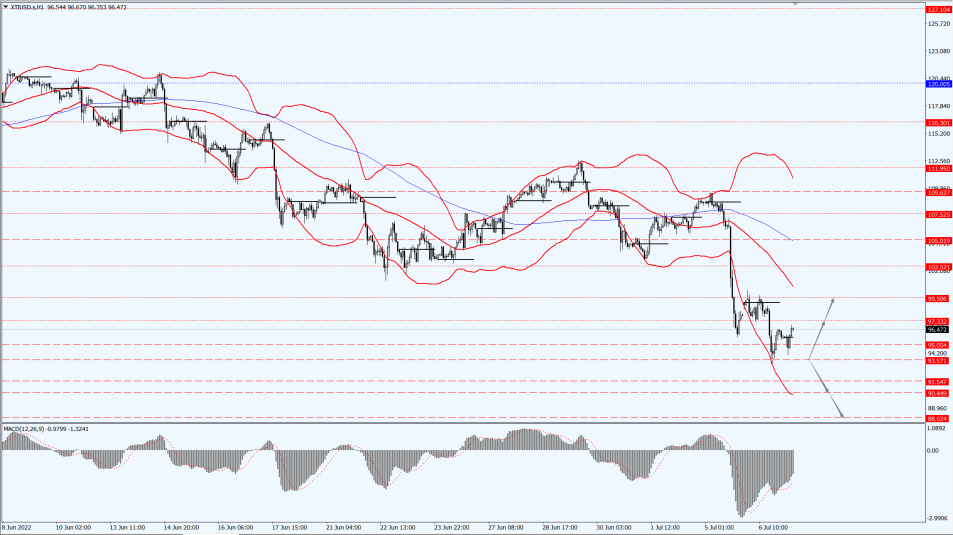

(Crude oil 1-hour chart)

Trading Strategies:

Oil prices focus on the 93.57-line today. If the oil price runs above the 93.57-line, then focus on the suppression strength of the two positions of 97.33 and 99.50. If the oil price runs below the 93.57-line, then pay attention to the support strength of the two positions of 90.44 and 88.02.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.