U.S. Stocks

Fundamental Analysis:

U.S. stocks closed lower Thursday, 17th February 2022, with the S&P 500 recording its biggest one-day percentage loss in two weeks, as heightened geopolitical tensions between the U.S. and Russia over Ukraine prompted investors to turn to defensive sectors and safe-haven assets such as bonds and gold.

Russia blamed Biden for heightening tensions and released a strongly worded letter saying Washington was ignoring its security demands and threatening “military-technical action,” without specifying.

During this interval, growing technology and communications services stocks were the hardest hit, while financial stocks fell as U.S. bond yields weakened.

Technical Analysis:

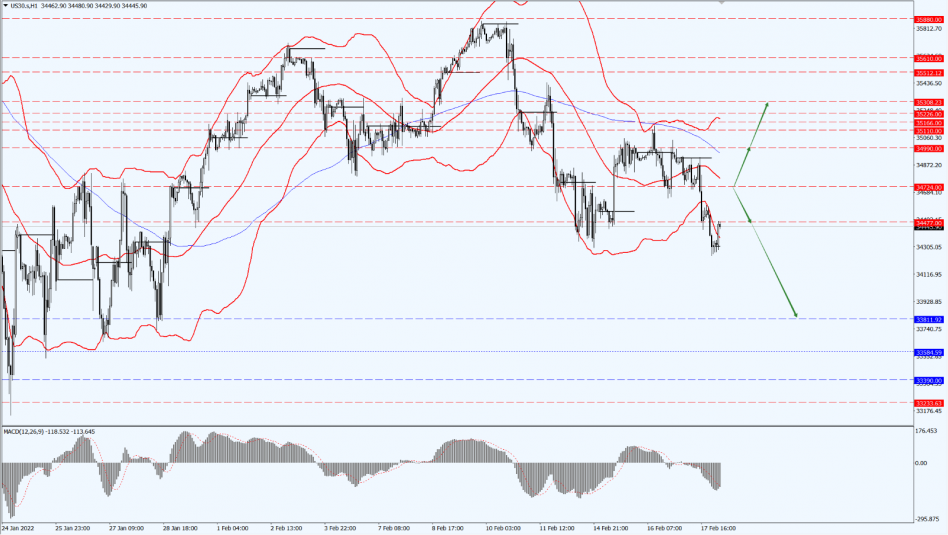

(Dow 30, 1-hour chart)

Execution Insight:

The Dow is focused on the suppression strength of the 34724-line today. If the Dow runs steadily below the 34724-line, it will pay attention to the support strength of the two positions of 34477 and 33811.

Hong Kong Stocks

Fundamental Analysis:

The Hang Seng Index opened by losing 159.11 points, or 0.64%, at 24633.66 points. The Hang Seng China Enterprises Index (HSCEI) opened down by 57.0 points, or 0.65%, at 8654.4 points. The Hang Seng China-Affiliated Corporations (Red Chip) Index (HSCCI) opened down by 9.04 points, or 0.21%, at 4282.5 points.

In addition, the Hang Seng TECH Index (HSTECH) fell by 0.9%. Large technology stocks fell in general, as Kuaishou Technology (1024.HK), Meituan (3690.HK), Xiaomi Corporation (1810.HK), NetEase, Inc. (9999.HK) are down by more than 1%.

The pharmaceutical sector was the top decliner, with BeiGene, Ltd. (BGNE) falling by more than 5%, while 2269.HK – WuXi Biologics (Cayman) Inc. fell by more than 2%.

Huitongda Network Co., Ltd. (9878.HK) landed on the Hong Kong Stock Exchange on the first day, opened up by 1.28%, with the opening price of HK$ 43.55 and the issue price of HK$ 43 per share.

Technical Analysis:

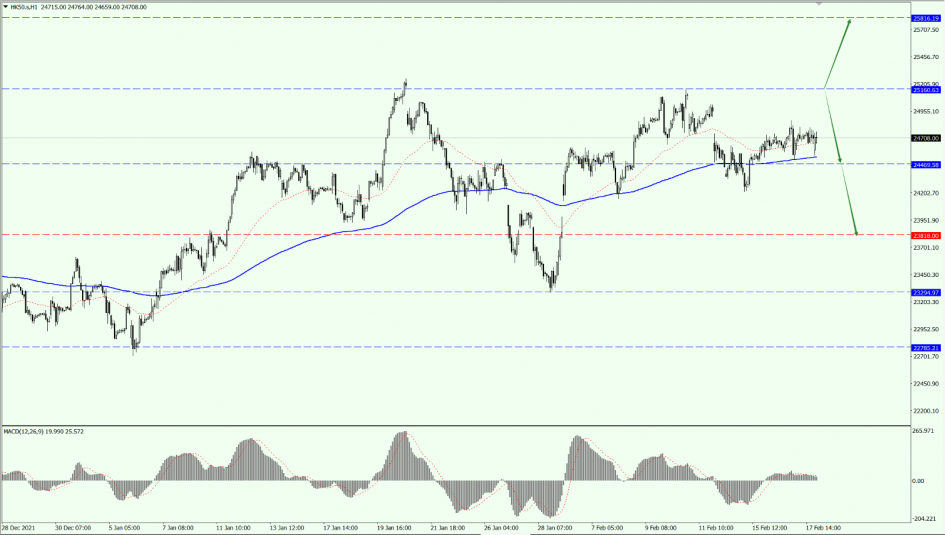

(HK50, 1-hour chart)

Execution Insight:

HK50 Index focuses on the 25160-line today. If HK50 can run stably below the 25160-line, then pay attention to the support strength of the two positions of 23818 and 24469. If the HK50 runs above the 25160-line, then pay attention to the suppression of the 25816-line.

FTSE China A50 Index

Technical Analysis:

(FTSE China A50, 1-hour chart)

Execution Insight:

FTSE China A50 pays attention to the support strength of the 14669-line today. If the A50 runs steadily above the 14669-line, then the top will pay attention to the suppression strength of the two positions of 15184 and 15666. If the strength of the A50 breaks below the 14669-line, it will open up a further downside space.

Risk Disclosure

Trading in financial instruments involves a high degree of risk due to fluctuations in the value and price of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with us. You should seek independent professional advice if you do not understand the risks disclosed by us herein.

Disclaimer

While every effort has been made to ensure the accuracy of the information in this document, DOO Prime does not warrant or guarantee the accuracy, completeness or reliability of this information. DOO Prime does not accept responsibility for any losses or damages arising directly or indirectly, from the use of this document. The material contained in this document is provided solely for general information and educational purposes and is not and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell, securities, futures, options, bonds or any other relevant financial instruments or investments. Nothing in this document should be taken as making any recommendations or providing any investment or other advice with respect to the purchase, sale or other disposition of financial instruments, any related products or any other products, securities or investments. Trading involves risk and you are advised to exercise caution in relation to the report. Before making any investment decision, prospective investors should seek advice from their own financial advisers, take into account their individual financial needs and circumstances and carefully consider the risks associated with such investment decision.