When it comes to hedging chaos, two assets stand out: gold and Bitcoin. One’s been trusted for thousands of years. The other is barely a teenager but already making waves that shake the old guard.

And right now, with geopolitical risks simmering down and the market eyeing Powell’s next move, these two are in a head-to-head contest for investor cash.

So, which could be a safe haven for the rest of 2025? Let’s find out.

Why This Matters Now

The Middle East peace talks, plus Trump’s relentless push to ease global tensions, have removed a massive near-term risk. Oil’s cooled off. Inflation expectations are pulling back. That means the spotlight shifts to the Fed and how soon they’ll cut rates.

This is prime territory for gold and Bitcoin to prove who wears the safe-haven crown. Both thrive when the dollar loses steam, both benefit from falling real yields, and both attract the same nervous money looking to protect purchasing power.

But which one stands taller today?

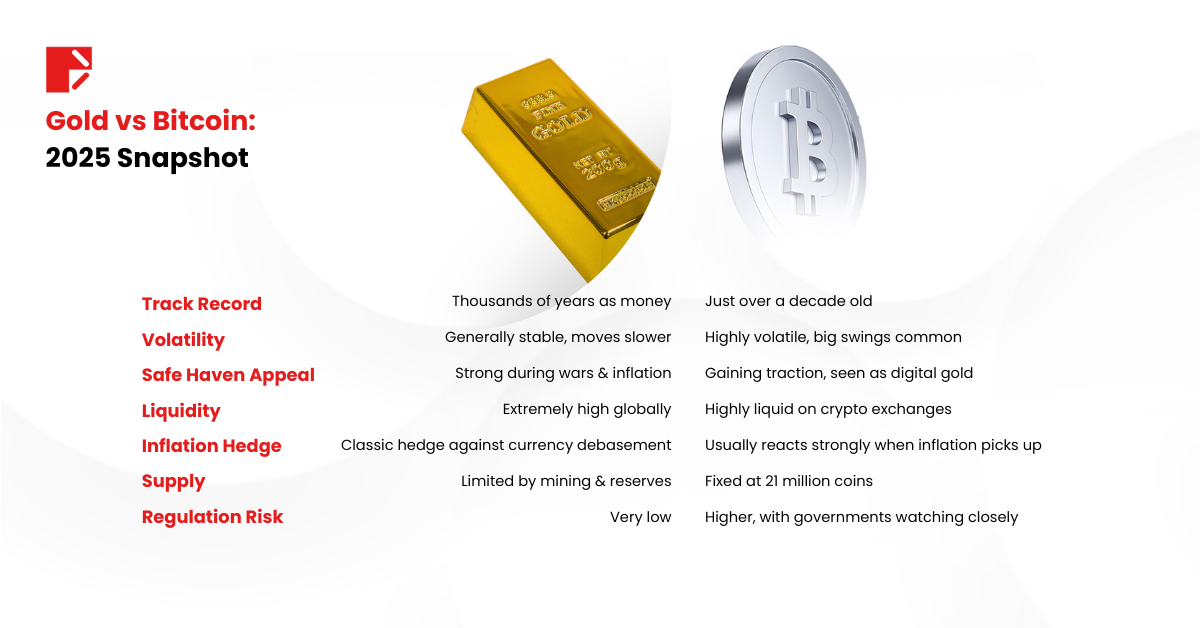

Gold vs Bitcoin: A Quick Side-by-Side in 2025

Before we explore what’s driving each market, let’s get a quick snapshot of how gold and Bitcoin compare on the fundamentals that matter most to investors right now.

Now that you’ve got the big picture, let’s unpack why gold could keep shining this year, and what might fuel an even bigger run for Bitcoin.

Gold: is $4,000 the Next Big Target?

Let’s start with gold. The metal recently pushed to new all-time highs near $3,500, before pulling back slightly.

Why the surge? A perfect storm of falling Treasury yields, central bank buying, and fears about longer-term debt sustainability. Even as the war premium fades, gold’s chart still looks strong.

If you check the technicals, gold is setting up a massive consolidation breakout above $3,500. This all started with a multi-year cup-and-handle that started building way back after the 2011 highs. If this pattern continues to play out, there’s a solid case for gold eventually challenging $4,000 and maybe beyond.

Gold is also the ultimate insurance policy. No tech risk, no counterparty, no blockchain hacks. Just a tangible asset that’s been trusted for thousands of years.

But it’s not without downsides. Gold is slow. It doesn’t yield. It moves at its own pace, grinding higher in cycles that can test even patient investors.

Bitcoin: Could $150K be Closer Than we Think?

Then there’s Bitcoin.

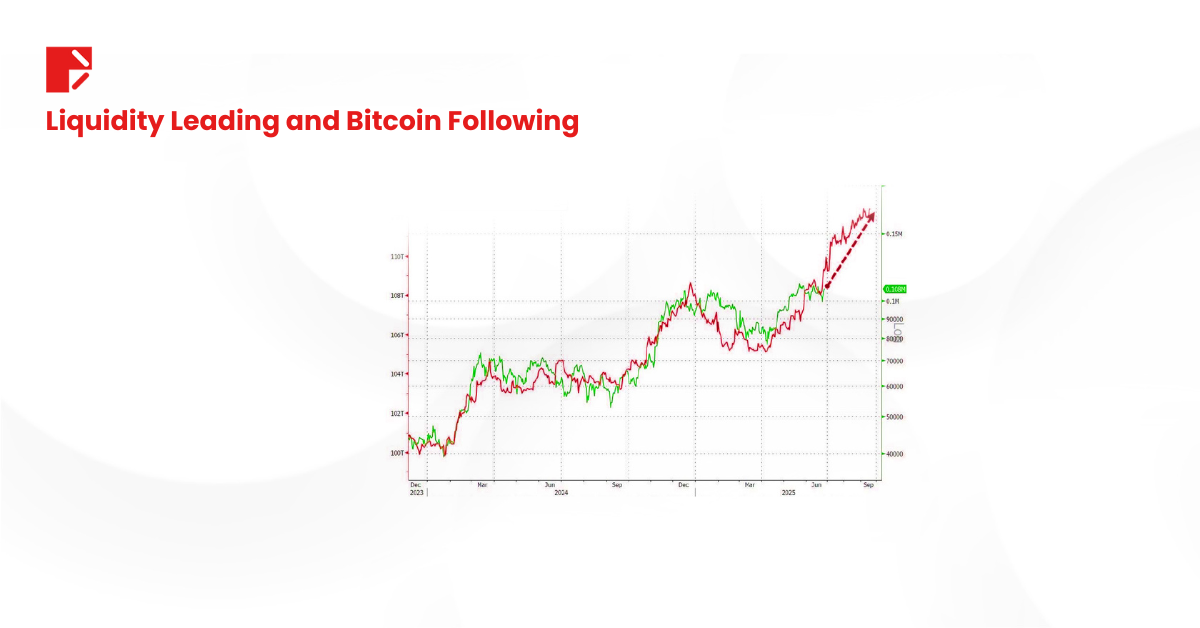

BTC is stuck between $110,000 and $100,000 for a month now. Institutions are piling in through ETFs. Trump’s Bitcoin reserve rumors only added more fuel. Meanwhile, the M2 money supply suggests Bitcoin could have even more room to run. Historically, Bitcoin has followed M2 with a ~12-week lag, which hints at prices catching up to global liquidity trends.

And remember, Bitcoin has one killer feature gold doesn’t: explosive strength. In 2011 it took silver just six weeks to jump from $35 to $50. Bitcoin can do that but faster and with far fewer catalysts.

It’s digital, borderless, and the supply is hard capped. That’s exactly why in an era where governments print money to solve problems, Bitcoin continues to find new converts.

But let’s not ignore the facts. Bitcoin is volatile. Double-digit swings in a day are normal. You’re also betting on continued adoption, tech infrastructure, and regulation behaving. It’s not old faithful like gold, it’s more like a high-performance sports car.

Gold vs Bitcoin: Which Makes More Sense Right Now?

So who wins?

It depends on your timeframe and risk appetite.

- Gold is slow, steady, and still incredibly reliable. It tends to move later in the cycle when real rates fall aggressively or the dollar starts a serious downtrend. It’s for investors who want less stress, more history, and fewer shocks.

- Bitcoin is for those chasing higher risk for the chance at higher rewards. It benefits directly from global liquidity, which if the Fed cuts rates aggressively, could mean new highs faster than people expect.

The smarter approach? Many are blending both. Allocating some capital to gold for insurance and some to Bitcoin for upside. Together, they create a modern hedge against both financial repression and inflation.

What to Watch Next

1. The Fed:

If Powell starts cutting, both assets could soar. Lower rates weaken the dollar and make alternatives more attractive.

2. Inflation data:

If oil prices spike again or tariffs stick, inflation could force the Fed to hold rates, which tends to support gold more directly.

3. Institutional flows:

More spot Bitcoin ETFs, sovereign funds dabbling in BTC, or central bank buying gold all drive fresh momentum.

4. Tech adoption vs. macro narrative:

Bitcoin needs continued tech adoption. The precious metal just needs global debt to keep growing, which seems pretty likely as it hit new record highs over $324 trillion.

Gold vs Bitcoin: Could Both Work?

Gold and Bitcoin aren’t enemies. They’re teammates in a portfolio that needs protection against a global system hooked on debt and liquidity.

Right now, with war risks fading and attention shifting to central banks, both could shine. The real question isn’t gold or Bitcoin; it’s how much of each fits your strategy.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This material constitutes general market commentary and is not prepared in accordance with legal requirements designed to promote the independence of investment research. As such, it is not subject to any prohibition on dealing ahead of the dissemination of investment research. This article is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. Any price levels discussed are illustrative only and do not constitute a forecast or advice.

The information provided herein is not intended for residents of any jurisdiction where its distribution or use would violate local laws or regulations. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.