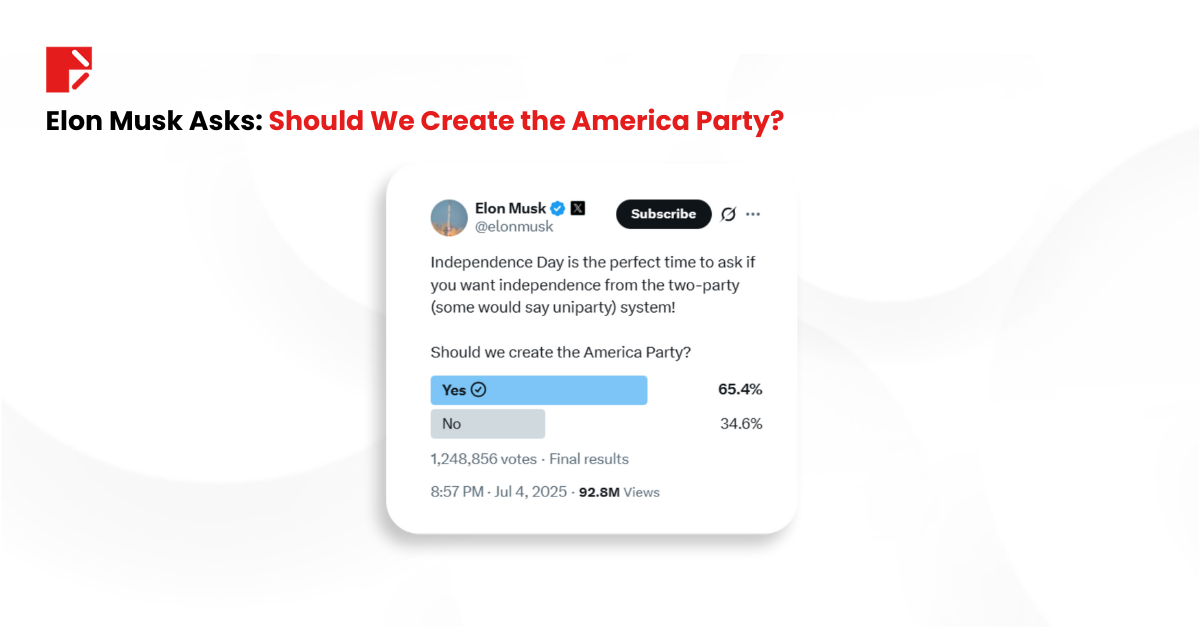

Elon Musk is back in the headlines. This time not for rockets or robotaxis, but for launching his very own political movement: the America Party.

At first glance, it might seem like a wild billionaire side quest. But take a closer look, and it starts to look like a significant new move that could impact how political and economic discussions evolve. And it might just be bullish for Tesla (TSLA) in ways many on Wall Street are missing.

What is America Party?

So, what exactly is the America Party, and why did Musk create it?

In short, it’s Elon’s answer to what he sees as a broken system. The America Party is a new political movement aimed at disrupting the traditional two-party monopoly in the United States. Musk says it’s about encouraging free speech, broadening political debate, and potentially shaping tax and regulatory policies that also influence his businesses.

Whether it’s bloated spending, unfair tax codes, or regulatory red tape that blocks new technology. Musk wants to challenge all of it, and build a system where the best ideas, not the best lobbyists, win.

There’s another layer too. The America Party seems to be Musk’s strategic counter to threats like Trump’s proposed tariffs on European EVs, which could hurt Tesla’s Berlin operations. By creating his own political force, Musk isn’t just playing defense, he’s going on offense, shaping the conversation and pushing for policies that keep the US competitive in tech, energy, and advanced manufacturing.

In simple terms: the America Party is Musk’s way of rewriting the rules of the game and putting power back in the hands of people who actually build things.

How Could Musk’s America Party Affect Tesla?

So why does Musk’s America Party matter for TSLA?

Simple. By launching his own political movement, Musk isn’t just talking, he’s positioning himself to shape policies that directly impact Tesla. From trade deals that keep global supply chains smooth, to tax codes that favor true innovation over old-guard lobbying, Musk wants a system that rewards building, not backroom deals.

In a tough 2025 environment, with high interest rates, slowing consumer demand, and fierce EV competition, having a CEO who’s actively pushing for smarter, pro-tech policies could be a huge advantage.

Bottom line: the America Party might just give Tesla the political tailwinds it needs to stay ahead. And that could be more bullish than many investors realize.

The Psychology of the Market: Optimism vs. Fear

Investors tend to get jittery around political headlines. Uncertainty makes for choppy price action. But sometimes, the market forgets to zoom out.

Musk’s personal brand is all about challenging comfortable power structures. For many retail investors (and even some institutional players who’ve grown tired of cozy corporate politics), that’s exactly why they back Tesla. They see it as the anti-establishment choice.

That means Musk’s political adventure could actually reinforce the TSLA narrative: a bold, world-changing company led by someone who doesn’t bow to entrenched interests. That’s not just good for optics; it keeps the retail army engaged, the same force that’s helped Tesla defy countless short calls over the years.

Has Any Other CEO Tried Politics Like Musk?

Plenty have tried. Howard Schultz flirted with a presidential run while steering Starbucks. And other business figures, like the Koch brothers, also supported policy causes over decades, sometimes leading to mixed public and market reactions.

The difference is that Musk is in a league of his own. He’s not just another CEO, he’s leading companies that are rewriting the rules in space, energy, transport, and AI all at once. His influence stretches far beyond typical boardrooms.

Unlike quiet corporate donors who pull strings from the shadows, Musk is loud, direct, and takes his ideas straight to the public. That open approach could win more allies than enemies over time.

Will Musk’s America Party Hurt or Help TSLA Stock?

Could TSLA see short-term volatility? Absolutely. The market doesn’t like new variables. Traders might worry about political distractions or fresh regulatory battles.

But narrative alone doesn’t sink great companies. It’s fundamentals that decide who thrives or fails. And Tesla’s fundamentals, from SpaceX rockets to Starlink satellites, EVs, AI breakthroughs, Optimus robots, and robotaxis, still look bright.

So sure, the story might get noisier. But this is still Tesla. And it’s hard to bet against a company that’s literally launching spaceships while teaching cars to drive themselves.

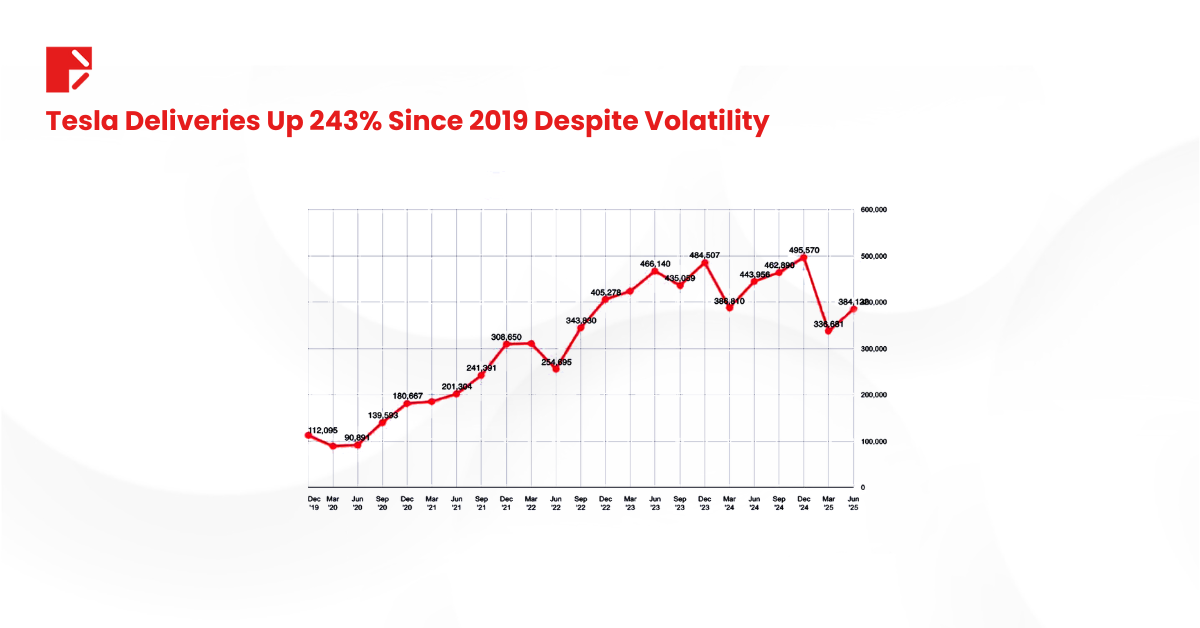

Tesla Deliveries: Long-Term Growth Still on Track

If you step back and look at Tesla’s actual delivery numbers, the picture is clear. Since Q4 2019, TSLA has grown quarterly deliveries by an impressive 242.68%, with a solid 25.1% compound annual growth rate.

Sure, the past few quarters have been a bit choppy. That’s normal for a fast-growing company navigating global supply chain swings, rate pressures, and rising competition.

But looking from a big picture perspective, despite the bumps, the long-term trajectory is still up. TSLA continues to expand its reach in the EV market, stacking new factories, rolling out tech like Optimus and FSD, and setting the stage for future growth.

Musk’s America Party might add political noise, but the fundamentals show a business that’s still powering forward. And that’s what ultimately supports Tesla’s stock, no matter how loud the headlines get.

Key Takeaways for Tesla and the America Party

Is Musk’s America Party bullish or bearish for TSLA?

If you look narrowly, it is another round of headlines that could make some investors uneasy. But take a bigger view, and it looks like a smart push to fix a system that often slows down the very innovation Tesla needs to stay ahead.

So keep watching. Musk is not just grabbing attention. He is trying to change the rules entirely. And if he pulls it off, Tesla could end up being one of the biggest winners.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements may result in substantial losses, potentially exceeding your initial investment within a short period of time.

Please make sure that you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This material constitutes general market commentary and has not been prepared in accordance with legal requirements designed to promote the independence of investment research. As such, it is not subject to any prohibition on dealing ahead of the dissemination of investment research. This article is not intended to constitute investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. Any price levels or market references discussed are for illustrative purposes only and do not constitute a forecast or advice.

The information provided herein is not intended for use by residents of any jurisdiction where its distribution or use would violate local laws or regulations. It does not take into account any specific recipient’s investment objectives or financial situation, or particular needs. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties as to the accuracy or completeness, or reliability of this information provided and accept no liability for any losses or damages resulting from the use of this material or from any investments made based on it.

The above information should not be used or considered as the basis for any trading or investment decisions nor as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report/material and assumes no responsibility for any losses resulting from the use of this report/material. You should not rely on this report/material to replace your independent judgment. The market is risky, and investments should be made with caution.

This material is strictly neutral and non-partisan. Any references to public figures or political developments are solely for context or illustrative purposes and do not reflect the views or positions of Doo Prime or its affiliates.