It’s 2025, and the market’s looking like a battlefield. Tech giants and growth stocks are down, and investors are double-checking their stop-loss orders. But in the middle of this chaos? Palantir’s not just holding, it’s rising.

While the broader market is in correction mode, Palantir Technologies (PLTR) is enjoying a breakout year. The stock is green, the headlines are bullish, and Wall Street can’t stop talking about it.

So, what’s driving Palantir’s outperformance in a down year for most?

Government Contracts Keep Rolling In

Palantir’s bread and butter has always been its deep ties with government agencies, and in 2025, that hasn’t changed, it’s intensified.

With rising geopolitical tensions and a global push for defense modernization, countries are pouring money into AI-driven intelligence, battlefield analytics, and surveillance systems. That’s Palantir’s wheelhouse.

- In Q1 alone, Palantir announced three new multi-million-dollar contracts with defense departments across Europe and Asia.

- Its long-standing relationship with the U.S. Department of Defense was recently extended with a $1.2 billion renewal deal.

While consumer tech gets hit by lower spending and advertising pullbacks, Palantir’s government clients are doubling down and it’s showing on the balance sheet.

AI is Booming and Palantir is a Quiet Giant

Yes, NVIDIA’s the face of the AI boom. But Palantir is the spine.

Its Foundry and AIP platforms are gaining real-world traction, especially in healthcare, logistics, and manufacturing. This isn’t just hype, it’s real-world AI in action. These are operational, cost-cutting, decision-enhancing tools that companies are actually using.

In 2024, Palantir pivoted harder into enterprise AI. Fast forward to now, and:

- Their commercial revenue grew over 35% YoY, with major adoption across Fortune 500s.

- The much-hyped Artificial Intelligence Platform (AIP) is being used by industries ranging from pharmaceuticals to energy.

Investors are realizing this isn’t a hype stock anymore, it’s an execution story.

Is Palantir (PLTR) Profitable?

Here’s a line you don’t hear often in the growth tech world: Palantir is profitable and consistently so.

After years of being dismissed as a cash-burning machine, Palantir turned the corner in 2023. And in 2025, it’s showing real financial maturity:

- 7 consecutive quarters of GAAP profitability

- Gross margins above 75%

- Strong free cash flow and zero debt

This puts Palantir in rare company. In a market environment where cash is king, profitability is attracting the big boys, such as institutions, hedge funds, and long-only managers who want exposure to AI, but not the risk of early-stage names.

Technical Analysis on PLTR Stock

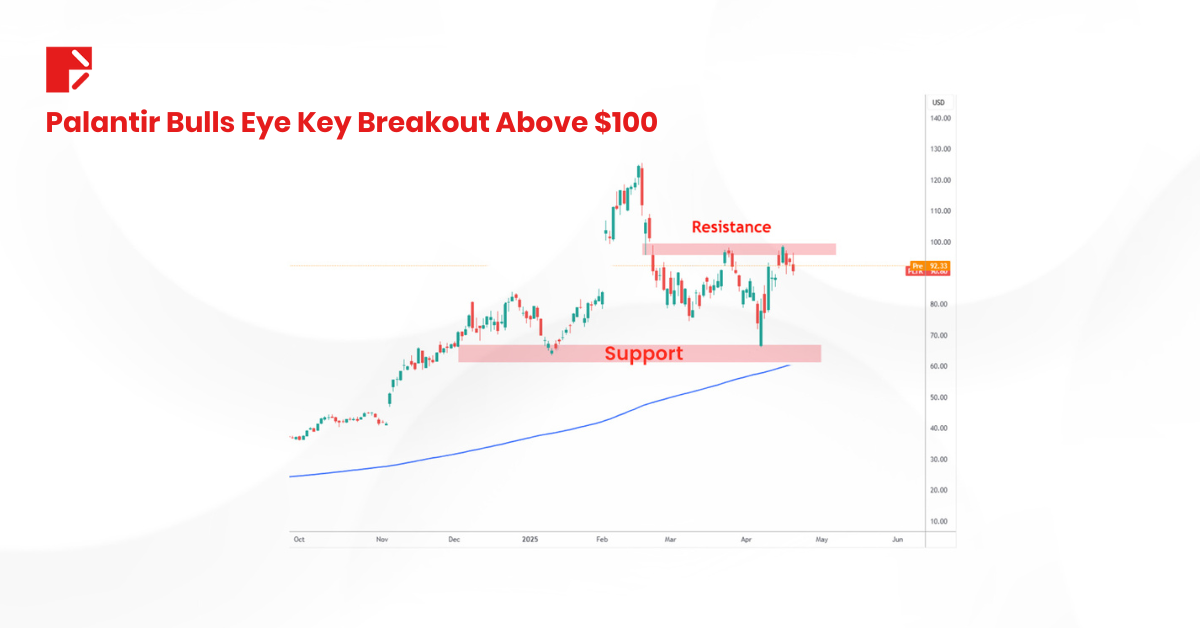

Zoom out to the chart, and it’s not hard to see why traders are piling in. After forming a long base throughout 2023 and early 2024, Palantir broke out above key resistance at $45 and hasn’t looked back.

Fast forward to today. Palantir is trading in a range between $60 support and $100 resistance. Bulls are looking for a clean breakout above $100 to fuel a potential move toward all-time highs.

Retail traders love the story. Institutions love the numbers. Momentum traders love the setup. And in a market where many tech names are stuck in a downtrend, Palantir is hitting higher highs and higher lows, a textbook uptrend that’s attracting all types of capital.

The Global Macro Environment is Helping

Funny enough, the very things hurting most of the market: war, volatility, and deglobalization are actually tailwinds for Palantir.

- Increased military budgets globally are fueling demand for defense tech

- The push for data sovereignty is making countries seek localized AI systems, something Palantir specializes in

- Ongoing economic uncertainty is pushing companies to seek efficiency, automation, and better forecasting tools, again, Palantir’s sweet spot

In short, Palantir isn’t just surviving the macro storm, it’s thriving in it.

Is It Too Late to Buy Palantir?

That’s the golden question. With the stock up over 20% year-to-date, is this still a good entry?

Well, it depends on your horizon.

If you’re chasing short-term gains, expect volatility. Palantir’s no stranger to big swings. But if you believe in the long-term story of AI infrastructure, government resilience, and enterprise adoption, this may still be early innings.

Wall Street analysts are starting to revise their targets upward, with some even putting $160+ price targets into play if growth continues at this pace.

The Catch: Palantir’s Not Perfect

No stock goes up in a straight line, and Palantir’s got cracks.

Its price-to-earnings ratio is steep, over 70, meaning it’s priced for flawless execution. So, a missed earnings or lost contract could spark a sell-off.

Rivals like Snowflake and Databricks are circling, hungry for the same enterprise dollars. Government deals, while juicy, aren’t guaranteed, budget cuts or delays could impact PLTR stock performance.

Traders and investors need to keep an eye on PLTR’s May 5 earnings, as what the company says about the future will matter more than the headline numbers.

The Bottom Line: Palantir’s a Standout

Palantir’s 2025 surge is more than just a lucky run in a weak market. It’s the result of strategic positioning, real-world utility, and finally, strong execution.

For years, this stock was a battleground between bulls who believed in its vision and bears who saw only hype. But now? The numbers are backing the story.

And while many names are still fighting to find a floor, Palantir is busy climbing.

Bottom line? Not all stocks are down and Palantir might just be one of the smartest ways to play the new AI economy.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.